Flash News

Flash News

Photo/ Brawl at a counting center in Kukës, police try to stop the young man

The first ballot box is counted in Tirana, the DP leads in Unit 2

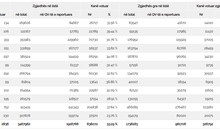

5 ballot boxes are being counted in the Gjirokastra district, here's how the votes are divided

The first 6 ballot boxes are opened for counting in Kukës

Figures from the CEC are out: 42.16% of Albanians within the country voted in the parliamentary elections

Pandemic, WB: Remittances in Albania in 2020 reached 1.5 billion dollars, the lowest in the region

The remittance industry has been part of the acceleration of digitalization, which is observed in many dimensions of life during the COVID crisis 19.

Starting in June 2020, remittance flows through digital channels have increased, according to a new World Bank report, particularly for migrants with access to bank accounts and credit cards.

The report shows that Albania ranks in the top ten recipients of remittances in Europe and Central Asia, although in lower figures than the region.

According to the report, the main beneficiary of remittances in Europe has been Ukraine, followed by Russia and Uzbekistan. Albania, last with 1.5 billion dollars in 2020, while in relation to GDP, 9.7%.

The report explains that, in the face of a severe labor shortage in key sectors (such as agriculture, construction, hospitality and care services) amid the COVID-19 crisis, the German government decided to extend the Western Balkans regulatory program under which citizens of Albania, Bosnia and Herzegovina, Kosovo, Montenegro, Northern Macedonia and Serbia enjoy privileged access to the German labor market.

"In addition, the citizens of the Western Balkans benefited the most from the new Immigrant Workers Immigration Act. "Of the 30,200 high-skilled visas issued in 2020, a total of 2,024 were issued to Serb citizens, 1,159 to Bosniaks and 778 to Albanian citizens," the report said.

In terms of the digitalisation of the sector, the report shows that, many major money transfer operators reported double-digit increases in their digital services, in stark contrast to the decline in their remittance services. The transition from cash to digital channels appears to have continued throughout 2020. Recent data showed that cross-border remittances increased by 65% in 2020 (from $ 7.7 billion in 2019 to $ 12 billion in 2020), reaching over 1 billion dollars in transactions sent and received each month (Andersson and Naghavi 2021, GSMA). "It is believed that there has been a large shift in flows from informal to official channels in 2020," said the WB.

Since digital remittances are better recorded than cash remittances, especially those made by hand or sent through other informal channels, official data is likely to record more remittances even if the true size of remittances may decline. . This observation is consistent with the fact that a large number of households surveyed in Q2 reported receiving lower remittances since the start of COVID-19 in Mexico (35%) and the Dominican Republic (54%) even when central banks registered higher inflows.

The true size of remittances, which includes official and informal flows, is believed to be larger than officially reported data, although the extent of COVID-19's impact on informal flows is unclear, the Bank notes./ Monitor

Latest news

Counting begins in Shkodra district, first two ballot boxes open, DP leads

2025-05-12 01:41:21

Photo/ Brawl at a counting center in Kukës, police try to stop the young man

2025-05-12 01:04:32

The first ballot box is counted in Tirana, the DP leads in Unit 2

2025-05-12 00:56:22

Vote counting begins in Mirdita

2025-05-12 00:25:21

Noka accuses Balla: His bags will be separated! I will monitor every vote

2025-05-12 00:01:41

Journalist: Patronage agents who took voters and took them to vote

2025-05-11 23:49:19

The first 6 ballot boxes are opened for counting in Kukës

2025-05-11 23:22:21

Celibashi with foreign observers arrives at the Olympic Park for Diaspora votes

2025-05-11 22:56:36

The first 3 boxes in Pustec are counted, how the result is presented

2025-05-11 22:53:25

Helena, as Rama's tool to attack the CEC

2025-05-11 22:31:34

Organized crime "oriented" the vote in Durrës

2025-05-11 22:21:32

Albania is a very strange place.

2025-05-11 22:11:51

Meta: The drug state is giving up, it cannot stop the people's victory

2025-05-11 21:41:12

Rape of commissioner and his family in Pogradec, 4 more wanted citizens arrested

2025-05-11 21:24:36

Vote counting begins in Pustec, including diaspora votes

2025-05-11 21:11:22

Tension at the shelter of patronage activists, police escort 3 people

2025-05-11 20:56:33

Berisha accuses PS: After "Petro Nini" illegal office also in Astir

2025-05-11 20:56:30

First ballot box counted in Vora, DP leads in Domje

2025-05-11 20:22:06

Dibra records record turnout in elections, Vlora least interested

2025-05-11 19:43:00

Police intervene at the office of the patronage workers in Tirana

2025-05-11 19:18:52

Elections 2025, voting hours officially end

2025-05-11 19:05:14

Elections 2025: Law for one party, tolerance for the other

2025-05-11 18:46:14

OSCE-ODIHR observers monitor the voting process in Saranda

2025-05-11 18:22:13

SP's request to postpone voting hours in Vlora fails at CEC meeting

2025-05-11 18:13:04

Bozdo: Go out and vote, your will will be unchangeable!

2025-05-11 18:00:38

A word of advice for government thugs

2025-05-11 17:52:40

Accident on the Korça - Pogradec axis, two injured near the village of Pirg

2025-05-11 17:50:14

Another person arrested for photographing the vote in Elbasan County

2025-05-11 17:27:53

Electoral crimes/ Xibra administrator and a person from Klosi reported to SPAK

2025-05-11 16:55:01

Parliamentary Elections 2025/ National turnout by 4:00 PM reaches 35.88%

2025-05-11 16:45:24

Conflict in Fushë-Milot, police issue statement: No shell casings found

2025-05-11 16:42:20

The brother of the SP candidate in Belsh intimidates voters

2025-05-11 16:24:53

Clashes in Vore CEAZ, CEC revokes observers' accreditation

2025-05-11 16:15:41

These fruits and vegetables remove toxins from the liver

2025-05-11 16:03:45

Elections 2025/ Diaspora votes massively, participation until 3:00 PM

2025-05-11 15:59:13

Fight at a polling station in Fushë-Milot, gunshots fired

2025-05-11 15:56:15

Figures/ Vlora, the region with the lowest voter turnout

2025-05-11 15:37:55

Elections 2025/ What was the voter turnout until 3:00 PM?

2025-05-11 15:32:37

Celibashi: Photographing votes is punishable by 3 years in prison

2025-05-11 15:13:50

Erion Veliaj votes in the Durrës detention center

2025-05-11 14:59:57

Low turnout, CEC releases figures: How many citizens have voted by 2:00 PM

2025-05-11 14:31:11

Citizens from Kosovo vote in Kukës

2025-05-11 14:11:33

The electoral process in Librazhd is interrupted, a person photographed the vote

2025-05-11 13:54:30

Celibashi: 8% of polling stations opened late

2025-05-11 13:47:12

Tragic accident in Peshkopi, police officer Veli Gjura dies at Trauma Hospital

2025-05-11 13:43:02

Berisha on vote alienation: Whoever violates the law will be held responsible

2025-05-11 13:26:47

CEC: Voter turnout until 12:00, lower than in 2021

2025-05-11 13:00:45

Bride votes before going to wedding in Elbasan: Democracy before the ceremony

2025-05-11 12:41:23