Flash News

Flash News

Kosovo opens embassy in Malaysia

At first he ridiculed them as 'flying carpets' and then he adopted them/ 7 themes and promises that Edi Rama copied from Sali Berisha in this campaign

Edi Rama's return to the (losing) 2011 campaign

The US withdraws from peace negotiations between Ukraine and Russia.

Vice President Vance's statement distributed by the American Embassy: Where did he say it, in what context, and how does it relate to Albania?

Compulsory insurance: Risk premiums between companies vary by up to 82%

The Financial Supervisory Authority (AMF) approved in March the updated mandatory property insurance risk premiums for insurance and non-life companies.

Risk premiums are the premiums on the basis of which insurance companies must calculate provisions (reserve funds) for the risk assumed with the insurance product.

The risk premium also represents a type of reference for the cost of the product or the premium below which the regulator cannot allow companies to offer insurance contracts.

As for cars, the risk premium is calculated in two bands, for vehicles with engine capacity less than 1600 cm3 and more than 1600 cm3. The risk premium for each of these two categories has significant differences.

For vehicles up to 1600 cm3, insurance companies calculate risk premiums in the range of 5000 to 9100 lek, while for vehicles over 1600 cm3, risk premiums start from 9100 to 12000 lek.

Companies have calculated risk premiums with quite large differences from each other, despite the fact that the product risk is assumed to be similar for all companies.

Based on the above figures, for vehicles with engine sizes up to 1600 cm3 the difference in risk premium between companies reaches up to 82%, while for vehicles with engine sizes over 1600 cm3 the differences are smaller, up to 32%.

On average, the risk premium for vehicles in the first group is 7,700 lek, while for those in the second group it is around 10,700 lek.

Although the risk premium varies considerably between companies, the same does not happen with the final price that drivers pay for insurance. If you calculate the price of vehicle insurance, through the automatic applications that companies offer on their websites, the differences are very small.

The minimum price of mandatory vehicle insurance has a difference of less than 2% between different insurance companies in the country.

The minimum price is the one that simultaneously includes the factors with the lowest level of risk, according to the new system that came into effect this year (engine power less than 1300 cm3, age up to five years, age greater than 21 years, vehicle registered in the lowest risk districts, vehicle owned by an individual).

The fact that large changes in the risk premium have almost no reflection in the final sales prices raises questions about the functioning of competition in the compulsory motor insurance market, TPL.

Last year, insurance companies sold approximately 703 thousand compulsory motor insurance policies, for a total value of approximately 12.7 billion lek. Of these figures, the average gross written premium for a TPL insurance policy last year was approximately 18 thousand lek.

Based on the AFSA's latest analysis of technical efficiency ratios, at the end of 9 months 2024, domestic TPL insurance resulted in a profit rate, net of reinsurance, of 15.3%.

For the 2-month period January-February 2025, with the application of the new system, the average premium per contract reached approximately 19.5 thousand lek./MONITOR

Latest news

Analysis: Why is EU-Ukraine trade at risk of becoming less free?

2025-05-02 20:54:39

Refused asylum in Italy, 15 migrants sent to Gjadri camp

2025-05-02 20:30:04

Edi Rama's return to the (losing) 2011 campaign

2025-05-02 20:22:18

Moments of panic in Stuttgart/ Car "runs" into crowd of citizens

2025-05-02 20:02:06

Berisha: Rama travels twice as much as the US president

2025-05-02 19:00:58

Phoebe Gates accidentally reveals that Bill Gates has Asperger's syndrome

2025-05-02 18:45:02

US against "birth tourism": Parents who abuse tourist visas risk entry ban

2025-05-02 18:09:59

Elona Lalaj appointed General Director of Tirana Municipal Police

2025-05-02 17:33:39

Nallbati challenges SP opponents to a public debate in the center of Devoll

2025-05-02 16:53:26

The US withdraws from peace negotiations between Ukraine and Russia.

2025-05-02 16:42:13

Zodiac signs that always know when you're lying to them

2025-05-02 16:27:17

Trump makes changes to his inner circle

2025-05-02 15:56:38

Fire in an apartment on "Tish Daija" street in Tirana

2025-05-02 15:41:27

Who can stop the price increase?

2025-05-02 15:08:52

Trump makes changes to his inner circle

2025-05-02 14:34:04

Theft at Korça hospital, nurse and patient robbed

2025-05-02 14:33:14

Hotolisht residents warn Rama-Balluk: Either us or you

2025-05-02 14:21:58

May 11th Elections, US Embassy in Tirana distributes JD Vance's message

2025-05-02 14:07:14

Germany declares AfD party an extremist group

2025-05-02 13:59:52

Begaj hosts King Abdullah II of Jordan with a state ceremony

2025-05-02 13:10:20

Italian MP: Vote for a great man like Berisha to change your destiny

2025-05-02 12:53:19

Florenc Çapja extradited from Dubai today

2025-05-02 12:39:21

Berisha: Every village will have the infrastructure of city neighborhoods

2025-05-02 12:30:53

For a month in Albania, the tourist couple appeared happy on social networks.

2025-05-02 12:04:09

Bozdo meeting with farmers in Dimal: DP commits to real support for agriculture

2025-05-02 11:53:43

Diaspora for a Free Albania reports Belinda Balluku to SPAK

2025-05-02 11:41:15

British Lord Supports DP in Elections: It's Time for Change in Albania

2025-05-02 11:32:48

Anti-drug operation in Belgium, Italian-Albanian gang destroyed

2025-05-02 11:10:36

Murder in Shkodra, tourist stabs wife to death, shoots himself

2025-05-02 10:33:08

Compulsory insurance: Risk premiums between companies vary by up to 82%

2025-05-02 10:21:22

The DP electoral office in Cërrik is robbed

2025-05-02 10:11:07

Under investigation in Erion Veliaj's file, Ajola Xoxa appears before SPAK

2025-05-02 09:49:42

Hostage-taking and extortion, two young men extradited from Germany and Italy

2025-05-02 09:42:58

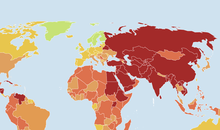

Reporters Without Borders: Deterioration of media freedom in Kosovo

2025-05-02 09:29:40

The DP headquarters in Cërrik was robbed during the night

2025-05-02 09:12:45

Olive oil remains in stock again, exports drop 75% for the period January-March

2025-05-02 08:49:08

Foreign exchange, the rate at which foreign currencies are sold and bought

2025-05-02 08:41:51

Early signs of dementia in young people in their thirties that are often ignored

2025-05-02 08:37:46

Horoscope, what do the stars have in store for you today?

2025-05-02 08:17:26

High temperatures, thermometer marks 31 degrees Celsius

2025-05-02 08:04:18

Posta e mëngjesit/ Me 2 rreshta: Çfarë pati rëndësi dje në Shqipëri

2025-05-02 07:49:13

DP candidate: Patronage agents follow us in cars during electoral meetings

2025-05-01 22:40:28

Forza Italia MP: Only Sali Berisha as Prime Minister can lead Albania to Europe

2025-05-01 21:29:47

For those who were scared by Tomorr Alizoti

2025-05-01 21:05:21

Berisha challenges Rama: You promised free healthcare, come here and keep it!

2025-05-01 20:56:58

The six best foods against stomach bloating

2025-05-01 20:04:09

Zelensky: We want peace, Russia responds with attacks

2025-05-01 19:22:07

Berisha: The contract in the US is not just for the DP, but for every Albanian!

2025-05-01 19:08:14

Fight between teenagers, 15-year-old ends up in hospital

2025-05-01 18:44:17