Flash News

Flash News

"Partizani" case, trial postponed to July 21 at the Special Court

Requested change of security measure, hearing for Malltez postponed to July 7

Trial for 'Partizan' today, Malltezi from SPAK: Witch hunt, a case that started with Balla's baseless complaint

Minimatura/ Last exam, around 28 thousand students are tested today in Foreign Language

The trial for the "Partizani" file begins today

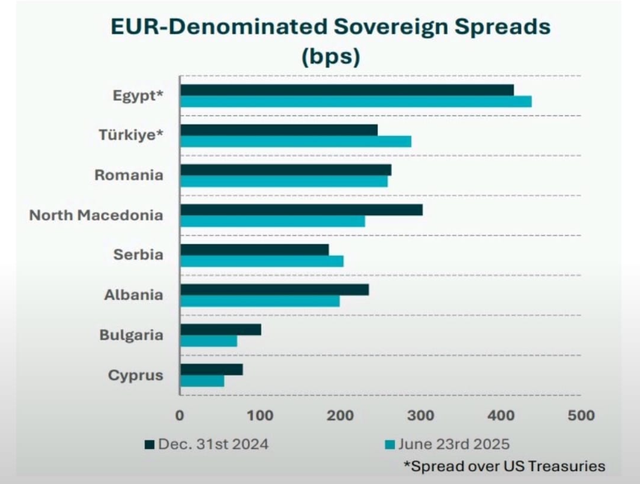

Chart/ Sovereign risk for Albania from international markets drops significantly

In the first half of 2025, Albania has marked a significant improvement in the perception of sovereign risk by international markets.

According to data updated on June 23, 2025, and published in a European Commission working document, the spread of Albania's sovereign bonds in euros over US Treasury bonds has decreased significantly, compared to the end of last year.

The chart shows that on December 31, 2024, the spread for Albania was higher, while in June 2025 it has decreased significantly, dropping to around 200 basis points (see chart below), signaling an improvement in financial credibility and reduced risk perception by international investors.

Albania ranks better than Egypt, Turkey, Romania, North Macedonia and Serbia, leaving behind a group of countries with higher levels of sovereign risk.

This development reflects a combination of positive factors, including improving fiscal indicators, macroeconomic stability, and a better perception of political stability and prospects for European integration.

The decline in the spread means that Albania can have more favorable access to international capital markets and finance public debt at a lower cost.

Compared to the end of 2024, similar improvements have been recorded by countries such as Serbia and Bulgaria, while Egypt and Turkey continue to remain at the top of the list with the highest risk, as indicated by the highest spread compared to US bonds.

The spread over US Treasury bonds shows how much extra interest investors are willing to pay to lend to a country, compared to a safe investment like US bonds.

A high spread indicates a higher perception of risk, and consequently a higher cost of borrowing. A low spread indicates greater confidence from the markets, which is associated with a lower cost of debt.

In the case of Albania, the decline in the spread in 2025 indicates improved financial credibility and reduced risk perception.

At the beginning of February, the Republic of Albania entered the capital markets for the 7th time, successfully issuing a Eurobond worth 650 million euros.

This Eurobond was issued with a coupon of 4.75% and an interest rate (yield) of 5%. The instrument has a life of 10 years and will mature in February 2035. Investor interest was high, contributing to the decrease in interest.

This is the most successful issue of the Republic of Albania, since the first issue in 2010.

Albania has marked a significant reduction in public debt in the last two years, prompting an improvement in its ranking by international rating agencies, such as Moody's and Standards & Poor's.

At the end of 2024, the country's public debt reached 54.74% of GDP, a decrease of 2.7 points compared to 2023. This was the lowest level of public debt in relation to GDP since 2008.

The decline in risk has also encouraged the diversification of the debt market. Since last year, foreign investors have started investing in Albanian government debt instruments in Lek. Bank of Albania data showed that for 2024, non-resident investors invested approximately 14 billion Lek in debt instruments in Lek.

This amount constituted approximately 28% of the additional borrowing of the Albanian government in the domestic financial market.

The participation of foreign investors is an important development, because it has increased demand and liquidity in the government securities market, contributing to the reduction of yields./ Monitor

Latest news

Fight between 4 minors in Kosovo, one of them injured with a knife

2025-06-30 12:38:45

Report: Teenage girls the loneliest in the world

2025-06-30 12:20:40

Commissioner Kos and Balkan leaders meet in Skopje on Growth Plan

2025-06-30 12:07:59

Wanted by Italy, member of a criminal organization captured in Fier

2025-06-30 11:55:53

Hundreds of families displaced by wave of Israeli airstrikes in Gaza

2025-06-30 11:45:17

Zenel Beshi: The criminal who even 50 convictions won't move from Britain

2025-06-30 11:23:19

A new variant of Covid will circulate during the summer, here are the symptoms

2025-06-30 11:14:58

"Partizani" case, trial postponed to July 21 at the Special Court

2025-06-30 10:41:05

Uncontrolled desire to steal, what is kleptomania, why is it caused

2025-06-30 10:30:08

Requested change of security measure, hearing for Malltez postponed to July 7

2025-06-30 10:24:32

Output per working hour in Albania 35% lower than the regional average

2025-06-30 09:54:35

The trial for the "Partizani" file begins today

2025-06-30 09:27:57

22 fires in the last 24 hours in the country, 2 still active

2025-06-30 09:21:28

How is the media controlled? The 'Rama' case and government propaganda

2025-06-30 09:13:36

German top diplomat: Putin wants Ukraine to capitulate

2025-06-30 09:00:07

Foreign exchange, how much foreign currencies are sold and bought today

2025-06-30 08:44:38

Chart/ Sovereign risk for Albania from international markets drops significantly

2025-06-30 08:26:38

Horoscope, what do the stars have in store for you?

2025-06-30 08:11:44

Clear weather and passing clouds, here is the forecast for this Monday

2025-06-30 07:59:32

Morning Post/ In 2 lines: What mattered yesterday in Albania

2025-06-30 07:47:37

Milan make official two departures in attack

2025-06-29 21:57:23

6 record tone

2025-06-29 21:30:46

4-year-old girl falls from balcony in Lezha, urgently taken to Trauma

2025-06-29 21:09:58

Assets worth 12 million euros seized from cocaine trafficking organization

2025-06-29 19:39:43

Fire in Durrës, Blushi: The state exists only on paper

2025-06-29 19:17:48

Fire endangers homes in Vlora, helicopter intervention begins

2025-06-29 18:27:51

France implements smoking ban on beaches and parks

2025-06-29 18:02:08

England U-21 beat Germany to become European champions

2025-06-29 17:42:49

Trump criticizes Israeli prosecutors over Netanyahu's corruption trial

2025-06-29 17:08:10

Street market in Durrës engulfed in flames

2025-06-29 16:52:57

UN nuclear chief: Iran could resume uranium enrichment within months

2025-06-29 16:03:24

Albanian man dies after falling from cliff while climbing mountain in Italy

2025-06-29 15:52:01

Another accident with a single-track vehicle in Tirana, a car hits a 17-year-old

2025-06-29 15:07:15

While bathing in the sea, a vacationer in Durrës dies

2025-06-29 14:54:01

Sentenced to life imprisonment, cell phone found in Laert Haxhiu's cell

2025-06-29 14:26:40

77 people detained in protest, Vučić warns of new arrests

2025-06-29 14:07:46

From a hospital for children to a prison for politicians

2025-06-29 13:34:02

77-year-old man found dead in Pogradec

2025-06-29 13:13:10

The Metropolitan of Gjirokastra passes away

2025-06-29 12:52:27

The 39th session to elect the speaker of Kosovo's parliament also fails

2025-06-29 12:31:28

France bans smoking on beaches and parks

2025-06-29 12:16:23

Alarm from the Philippines: Albania, a growing destination for labor trafficking

2025-06-29 11:50:34

After 2-year ban, Paul Pogba signs with Monaco

2025-06-29 11:15:15

Can Albania produce all the food it needs?

2025-06-29 11:02:12

New study says: ChatGPT can damage your brain

2025-06-29 09:25:26

Violence and clashes at student protest in Belgrade

2025-06-29 09:12:22

Foreign exchange, the rate at which foreign currencies are sold and bought

2025-06-29 08:59:46

Horoscope, what do the stars have in store for you today?

2025-06-29 08:33:06

Hot weather, temperatures reach 39 degrees Celsius

2025-06-29 08:16:12

Morning Post/ In 2 lines: What mattered yesterday in Albania

2025-06-29 08:01:38

"Article Basha, wrong"/ Bardhi against Berisha's removal with statute

2025-06-28 21:41:41

Two cars collide in Pogradec, 3 people injured

2025-06-28 21:29:25

The first from the end... Albania's unwanted "victories"

2025-06-28 21:10:43

War with Ukraine, Putin: I am convinced that Russia will win!

2025-06-28 20:54:16

ChatGPT "destroys" the human brain! New study publishes disturbing results

2025-06-28 20:31:34

Triple accident in Lapraka, two people injured

2025-06-28 20:13:39

EMRI/ Albanian cocaine smuggler risks life in prison in the US

2025-06-28 19:34:14

Rallies against Vučić continue, Belgrade prepares for major student protest

2025-06-28 18:23:29

A young man from Kosovo passes away after coming to Lezha on vacation

2025-06-28 17:42:10

Flames engulf the mountain in Maliq, flames near the former military tank depot

2025-06-28 17:18:08

Europe on heatwave alert, temperatures reach 42 degrees!

2025-06-28 16:19:55

Palm tree falls on "Epidamn" Boulevard in Durrës, blocking traffic

2025-06-28 15:58:08

WHO publishes final report on Covid-19: We cannot find its origin!

2025-06-28 15:42:16

A house in Shëngjin is destroyed by flames

2025-06-28 15:07:57

Police fire gun at vehicle in which young man was traveling

2025-06-28 14:44:02

4 caravans collapse in Tirana

2025-06-28 14:28:19

"Skënder's son and Gjergj's daughter, an Albania without competition"

2025-06-28 14:10:24

The Special Prosecution Office seizes assets worth around 12 million euros

2025-06-28 13:23:25