Flash News

Flash News

The mystery of Renis Dobra's murder, the two main leads of the investigation are revealed

Rama's ultimatum: On Monday, all heads of administrative units must be dismissed

Fires in the country, 4 fires still active, what is the situation?

Rama targets Shkodra prosecutor again: Gjeli wrote philosophical essay with innocence of illegal construction

Wanted for theft, 26-year-old arrested in Durrës

Minority in the Constitutional Court: The tax is higher than the EU and the Balkans, the rule of law is violated

The opinion of the minority of judges of the Constitutional Court on the lawsuit of the Association of Producers of Alcoholic Beverages, which requested the repeal of the law on the unification of excise duty, is clarified.

In the position against the majority that decided to overturn the producers' request and left in force the legal changes for the doubling of the excise tax, the two judges first argue that the Constitutional Court does not respect the principle of the rule of law in two cases with the same typology of consequences, the violation of proportionality.

"Taking into account the similarity of the two cases, we appreciate that the specific case should have the same conclusion as the result reached for the Tax Law - that of accepting the request, since the treatment in this case also has to do with examining the proportionality of the excise tax for small producers, for whom it immediately doubled due to unification. In this view, two diametrically opposed solutions, given in constitutional cases examined at the same time by the Court and with the same typology of consequences, do not respect the principle of the rule of law, in the sense of respecting the rule of continuity of jurisprudence" , cited in the minority opinion.

From January 1, 2023, after a 15-year period of differentiated excise duty depending on the amount of production, with the entry into force of the new excise law, the excise duty is unified, doubling it for beer producers under 200,000 HL per year , from the value of 360 ALL/HL to 710 ALL/HL.

For the two judges of the Constitutional Court who make up the minority opinion, the doubling of the excise duty is opposed for several reasons.

First, according to the opinion of the minority, the level of the imposed excise duty has not been chosen in the measure used by the vast majority of EU and Balkan countries, but has preferred to be ranked among those countries with the highest excise duty.

Secondly, in terms of the categorization of the production quantity, the reduced fee is not applied in support of small beers according to the EC directive.

"Despite the fact that European directives do not present an obligation for states to apply reduced tariffs, this practice is known and applicable and aims to differentiate beer producers depending on their capacities", the minority opinion states, among other things.

The two judges also argue that the doubling of the excise duty does not justify the avoidance of fiscal evasion as long as the brewing and trading industry is monitored by a tax stamp tracking system.

So in the decision of July 16, the Constitutional Court appreciated that during the trial it was not proven that the legal changes have violated the essence of the freedom of economic activity or put it at risk to the extent that its existence is questioned. In this perspective, the unification of the excise duty does not constitute a disproportionate tool. At the end of the examination of the case, for the above reasons, the Court decided, by majority vote, to reject the request.

At this point, we emphasize that the rapid entry into force of laws imposing obligations and/or restrictions should be an exception, based and justified in specific objective circumstances. This means that when changes are made in the fiscal field, such as the Anticipation of new obligations: or existing obligations, the time period left available for their entry into force must be justified only on the basis of the premise of guaranteeing a significant interest public, such as the stability of public finances.

In this direction and in the context of the constitutional principle of the rule of law, the legislator, in the cases of laws pertaining to the fiscal system, is obliged to provide for a sufficient period of time for the entry into force of the law, during which the subjects will to be able to prepare for the implementation of the requirements arising from the new legal rules. This gives the guarantee to them not only to familiarize themselves in advance with the new legal requirements, but also to adjust their property interests and prospects of economic activity in accordance with the new legal requirements. Despite this, in the present case, the legislator chose to immediately double the value of the excise duty. Seen under this lens, another milder tool selected by the legislator would be to reduce the threshold of 200,000 HL to a lower amount, similar to European models, or even to change the tariff proportionally for producers with over 200 000 HL per year./ Monitor

Latest news

Rama's ultimatum: On Monday, all heads of administrative units must be dismissed

2025-07-11 11:05:59

Fires in the country, 4 fires still active, what is the situation?

2025-07-11 10:56:23

Government irony: Rama strips Dredha of power, then demands law and order

2025-07-11 10:49:10

German media: Vlora Airport 'kills' one of Europe's largest wetlands!

2025-07-11 10:37:46

Amid the Alps in Theth, the law punishes even those who try to respect it

2025-07-11 10:14:16

Wanted for theft, 26-year-old arrested in Durrës

2025-07-11 10:03:29

After the dismissals, Rama gathers the mayors in Durrës

2025-07-11 09:42:29

Released on bail, Salianji appears before the Probation Service

2025-07-11 09:34:28

Haxhi Qamil Rama and the directors of the Municipalities!

2025-07-11 09:21:35

30 years since the Srebrenica massacre in Bosnia and Herzegovina

2025-07-11 09:10:52

From rhetoric to brandy, POLITICO: 9 things Nigel Farage can do in Albania

2025-07-11 08:53:35

Trump announces 35% tariffs on Canadian goods

2025-07-11 08:39:29

Foreign exchange, how much foreign currencies are sold and bought today

2025-07-11 08:24:25

Horoscope, what do the stars have in store for you today?

2025-07-11 07:59:39

Sun and high temperatures, weather forecast

2025-07-11 07:41:09

Morning Post/ In 2 lines: What mattered yesterday in Albania

2025-07-11 07:20:14

Zhupa: In Theth, some Austrian strategic investors want the empty area

2025-07-10 22:57:08

Malltezi: SPAK admits, we are in a process that began with Balla's false report

2025-07-10 22:34:16

Si të çliroheni nga bllokimet emocionale me anë të ushtrimeve

2025-07-10 21:57:24

Lala: Veliaj wanted to return as mayor

2025-07-10 21:40:46

VIDEO/ Brawl in Bolivian parliament, deputies physically clash

2025-07-10 21:20:30

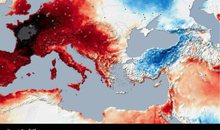

Albania experienced one of the longest heat waves of the last decade

2025-07-10 21:01:09

The Government approves new procedures for declaring residence in e-Albania

2025-07-10 20:39:32

Koka: Northerners will not forget Edi Rama's racist operation in Theth

2025-07-10 20:18:24

The 3 zodiac signs that will be most affected by the 'Full Moon' of July 10

2025-07-10 20:04:49

New director of the National Center of Cinematography appointed

2025-07-10 19:51:12

Korça/ 40-year-old man jumps from fifth floor balcony, in critical condition

2025-07-10 19:40:19

'Tired Woman'/ The Syndrome That Affects Thousands of Women Every Day

2025-07-10 19:34:02

Jane Birkin's original Hermès bag sells for $10 million

2025-07-10 19:26:22

Britain-Ukraine agreement signed for 5,000 Thales missiles

2025-07-10 19:00:25

Fire in Zvërnec, flames endanger two hotels

2025-07-10 18:57:19

Croatia restores compulsory military service

2025-07-10 18:39:01

Spahia: The great truth of the strong accusation of the residents of Theth

2025-07-10 18:35:07

The Supreme Court left him in prison, Meta addresses the 'Constitution'

2025-07-10 17:57:21

New punishment with 'new' regulations

2025-07-10 17:54:46

EU translator fired over fears for Zelenskyy's safety

2025-07-10 17:45:37

'You are a policeman, but not God, take my soul', protest for Agon Zejnullahu

2025-07-10 17:41:21

Video/ Rama repeats the scenario, kneels before Meloni again

2025-07-10 16:56:31

He set fire to a plot of olive trees, 50-year-old man arrested in Shijak

2025-07-10 16:46:19

Rubio: US and Russia have exchanged new ideas for Ukraine peace talks

2025-07-10 16:36:20

Death of 27-year-old, Lipjan Police Commander Resigns

2025-07-10 16:21:28

Video/ An apartment burns in Tirana near the New Bazaar

2025-07-10 16:09:36

Jensila lights up the internet with her birthday greetings to Ledri

2025-07-10 15:42:08

They're full of pesticides! List of 12 products we need to be careful of

2025-07-10 15:31:04

Worker falls from scaffolding in Shëngjin, urgently sent to Trauma

2025-07-10 15:11:03

Malltezi: Within one day they seized my accounts, properties and shares

2025-07-10 15:01:23

EU: Israel has agreed to more aid to Gaza

2025-07-10 14:55:19

Murder of Reni Dobra, 23-year-old's vehicle pulled from the water

2025-07-10 14:29:23

Trump's tariffs on Brazil raise coffee prices

2025-07-10 14:16:07

Ursula von der Leyen survives no-confidence vote

2025-07-10 14:04:27

Fire in Lezha, flames near electrical substation

2025-07-10 13:32:24

Residents clash with police in Theth, a woman faints

2025-07-10 13:24:38

"Rama and Xanun"

2025-07-10 13:15:46

Zodiac signs most likely to get divorced in July 2025

2025-07-10 12:45:51

A scapegoat for an illegitimate Republic

2025-07-10 12:35:02

"He has devastated his own nation"/ Berisha: Rama imprisons his opponents!

2025-07-10 12:26:54

Albanian man injured with knife in Italy

2025-07-10 12:08:55

23-year-old in Mat drowned with rope, 4 suspects are being held

2025-07-10 10:58:53

After the dismissals, the new director of the Shkodra Police is appointed

2025-07-10 10:30:10

BIRN: Rama's action for public spaces, a repeated spectacle

2025-07-10 10:29:11

Action in Theth, Shkodra Police leaders dismissed

2025-07-10 10:16:28

Fatal accident on the Tirana-Durres highway

2025-07-10 10:01:58

The incinerator does not exist, but the government continues to increase funds

2025-07-10 09:51:45

Albania is aging at a rapid pace! 30% of the population is over 60 years old

2025-07-10 09:46:23