Flash News

Flash News

Gunfire in Durres, a 30-year-old man is injured

Accident on Arbri Street, car goes off the road, two injured

Arrests of "Bankers Petrolium", Prosecution provides details: Exported and sold 532 billion lek of oil, caused millions of euros in damage to the state

Ndahet nga jeta tragjikisht në moshën 28-vjeçare ylli i Liverpool, Diogo Jota

Posta e mëngjesit/ Me 2 rreshta: Çfarë pati rëndësi dje në Shqipëri

Christine Lagarde warns of 'existential crisis' for continent as Donald Trump puts America first

Investors have warned of Europe's vulnerability to Donald Trump's "America First" policies.

Trump's plans for tax cuts and reforms sparked a burst of enthusiasm from many US leaders at the World Economic Forum in Davos this week, while on Wall Street the S&P 500 came very close to a new record at the close on Wednesday.

But the mood about Europe was much darker. One head of a major US bank warned of “maximum pessimism” for the continent. The threat of US tariffs on Europe added to the worries of leaders and politicians in Davos, who warned that a rising US economic wave could weaken confidence on the other side of the Atlantic.

Christine Lagarde, president of the European Central Bank, said it was not "pessimistic" to say that Europe is facing an "existential crisis".

Trump has inherited a rising

S&P 500 stock market (points)

Europeans had to be realistic, Lagarde said on a panel discussion. “We are now getting this big push because another major player in the global economy is organizing things in a different way and is threatening some of the partners and players that that country was cooperating with before.”

Forecasts from the IMF this month significantly improved the economic outlook for the US this year, predicting growth of 2.7%, well above the Eurozone's projected expansion of 1%.

The eurozone's largest economy, Germany, has seen two years of contraction and is forecast to expand by just 0.3% this year. Meanwhile, the US received a record share of cross-border greenfield investment projects in the 12 months to November, according to preliminary data from FDI Markets.

The main risk in the US is that Trump's agenda ends up fuelling inflation and preventing the Federal Reserve from cutting interest rates. The IMF warned of the risk of rising prices if Trump overstimulates the US economy while curbing the supply side of the economy by cracking down on immigration.

While stronger US demand will benefit countries that rely heavily on US exports, investors in Davos spoke of the risk that growth in Europe could undercut already gloomy forecasts.

Strained public finances in countries like France and the UK could leave them exposed to a further rise in long-term borrowing costs, driven by tax cuts in the US.

Rising US Treasury yields are raising European countries' borrowing costs

Ursula von der Leyen, president of the European Commission, said the EU and the US must negotiate to preserve trade relations, given that with trade volumes between them at 1.5 trillion euros and massive transatlantic investment, "much is at stake for both sides."

Brussels hopes that threats of high tariffs will be a precursor to deals that avoid some of those barriers, as they did in Trump's first term. But the gap with Brussels was on full display this week, after Trump announced the US withdrawal from the Paris climate agreement, a cornerstone of EU policy and the World Health Organization.

The European economy had shown “resilience” in the face of shocks such as Covid-19 and the rise in energy prices following Russia’s invasion of Ukraine, said Valdis Dombrovskis, the EU’s economy commissioner. But he acknowledged that deeper fragmentation in the global economic system would be “very costly for the EU, given that the EU is a trading superpower.”

At the same time, an attempt to change regulations in the US could further harm European competitiveness if governments fail to mount an effective response.

Regulation of technology and artificial intelligence will prove to be a key test./ Monitor

Latest news

Greece imposes fee to visit Santorini, how many euros tourists must pay

2025-07-03 20:50:37

Don't make fun of the highlanders, Elisa!

2025-07-03 20:43:43

Gunfire in Durres, a 30-year-old man is injured

2025-07-03 20:30:52

The recount in Fier cast doubt on the integrity of the vote

2025-07-03 20:09:03

Heatwave has left at least 9 dead this week in Europe

2025-07-03 19:00:01

Oil exploitation, Bankers accused of 20-year fraud scheme

2025-07-03 18:33:52

Three drinks that make you sweat less in the summer

2025-07-03 18:19:35

What we know so far about the deaths of Diogo Jota and his brother André Silva

2025-07-03 18:01:56

Another heat wave is expected to grip Europe

2025-07-03 17:10:58

Accident on Arbri Street, car goes off the road, two injured

2025-07-03 16:45:27

Accused of two murders, England says "NO" to Ilirjan Zeqaj's extradition

2025-07-03 16:25:05

Gaza rescue teams: Israeli forces killed 25 people, 12 in shelters

2025-07-03 15:08:43

Diddy's trial ends, producer denied bail

2025-07-03 15:02:41

Agricultural production costs are rising rapidly, 4.8% in 2024

2025-07-03 14:55:13

Warning signs of poor blood circulation

2025-07-03 14:49:47

Croatia recommends its citizens not to travel to Serbia

2025-07-03 14:31:19

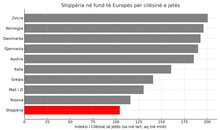

Berisha: Albania is the blackest stain in Europe for the export of emigrants

2025-07-03 14:20:19

'Ministry of Smoke': Activists Blame Government for Wasteland Fires

2025-07-03 13:59:09

AFF message of condolences for the tragic loss of Diogo Jota and his brother

2025-07-03 13:41:36

Five healthy foods you should add to your diet

2025-07-03 13:30:19

A unique summer season, full of rhythm and rewards for Credins bank customers!

2025-07-03 12:12:20

Fire situation in the country, 29 fires reported in 24 hours

2025-07-03 12:00:04

The constitution of the Kosovo Assembly fails for the 41st time

2025-07-03 11:59:57

The gendering of politics

2025-07-03 11:48:36

The price we pay after the "elections"

2025-07-03 11:25:39

Xhafa: The fire at the Elbasan landfill was deliberately lit to destroy evidence

2025-07-03 11:08:43

The 3 zodiac signs that will have financial growth during July

2025-07-03 10:48:01

Democratic MP talks about the incinerator, Spiropali turns off her microphone

2025-07-03 10:39:24

Ndahet nga jeta tragjikisht në moshën 28-vjeçare ylli i Liverpool, Diogo Jota

2025-07-03 10:21:03

Cocaine trafficking network in Greece, including Albanians, uncovered

2025-07-03 10:10:12

Korreshi: Election manipulation began long before the voting date

2025-07-03 09:39:13

Arrest of Greek customs officer 'paralyzes' vehicle traffic at Qafë Botë

2025-07-03 09:28:41

After Tirana and Fier, the boxes are opened in Durrës today

2025-07-03 09:21:10

Enea Mihaj transfers to the USA, will play as an opponent of Messi and Uzun

2025-07-03 09:10:04

Foreign exchange, the rate at which foreign currencies are sold and bought

2025-07-03 08:53:50

Index, Albania has the worst quality of life in Europe

2025-07-03 08:48:10

Horoscope, what do the stars have in store for you today?

2025-07-03 08:17:05

Clear weather and high temperatures, here's the forecast for this Thursday

2025-07-03 08:00:37

Posta e mëngjesit/ Me 2 rreshta: Çfarë pati rëndësi dje në Shqipëri

2025-07-03 07:46:48

Lufta në Gaza/ Pse Netanyahu do vetëm një armëpushim 60-ditor, jo të përhershëm?

2025-07-02 21:56:08

US suspends some military aid to Ukraine

2025-07-02 21:40:55

Methadone shortage, users return to heroin: We steal to buy it

2025-07-02 20:57:35

Government enters oil market, Rama: New price for consumers

2025-07-02 20:43:30

WHO calls for 50% price hike for tobacco, alcohol and sugary drinks

2025-07-02 20:41:53