Flash News

Flash News

Gunfire in Durres, a 30-year-old man is injured

Accident on Arbri Street, car goes off the road, two injured

Arrests of "Bankers Petrolium", Prosecution provides details: Exported and sold 532 billion lek of oil, caused millions of euros in damage to the state

Ndahet nga jeta tragjikisht në moshën 28-vjeçare ylli i Liverpool, Diogo Jota

Posta e mëngjesit/ Me 2 rreshta: Çfarë pati rëndësi dje në Shqipëri

The euro continues to plummet, the exchange rate falls to 107.4 ALL

The fall of the euro exchange rate continued at a high rate even today.

According to the official exchange rate of the Bank of Albania, the European currency was exchanged on Tuesday at 107.4 ALL, touching a new historical minimum. The annual decline of the euro has also reached a record level of 10.6%. In the last month alone, the euro has lost 3.5% of its value in the exchange rate with the lek.

According to exchange agents, the decline is explained by the very high supply of currency in the market. This offer coincides with the beginning of the tourist season, but certainly not with the peak of this season, so maybe tourism alone cannot explain the very high foreign exchange offer in the market.

Another hypothesis related to this period of the year could be the impact of non-resident citizens' investments on the real estate market. Bank of Albania statistics showed that property purchases by foreign nationals last year reached the highest historical level. They touched the value of 291 million euros, with an annual increase of 52%.

The psychological factor can also exert an influence, driving even more sales of the euro, due to seasonal expectations for an even stronger decline.

However, experts note that very strong exchange rate movements can also be linked to exchange operations in high values, which are usually associated with large companies, but which are difficult to identify.

In addition to the large inflows of foreign currency, this exchange rate trend can also be partially explained by the decrease in the supply of the lek. The expansion of the money supply in lek appears to be very low and slow, as evidenced by the slowdown of credit in the local currency, the weak growth of the monetary aggregate M2 and the further expansion of the budget surplus in the first half of this year.

The strengthening of the local currency in theory has a tendency to lower the cost of imports and narrow the country's current account deficit. This should translate into lower consumer prices and lower inflation, of course in the absence of other factors acting in the opposite direction. Such factors could be insufficient competition in the markets or increasing inflationary pressures from the labor market.

Leku i fortë po favorizon huamarrësit në monedhën europiane, që në shumicën e rasteve të ardhurat e tyre i kanë në monedhën vendase. Forcimi i lekut sjell ulje të nivelit të borxhit dhe të shpenzimeve për shlyerjen e tij. Përfituesi më i madh është qeveria shqiptare, që në fund të tremujorit të parë 2023 kishte një borxh të jashtëm në vlerën e afërsisht 4 miliardë eurove, ose afërsisht sa 33% e vlerës së përgjithshme të stokut të borxhit publik.

Kredia në euro dominon edhe në sektorin privat të ekonomisë. Sipas Bankës së Shqipërisë, më shumë se 52% e kredisë në fund të vitit të kaluar ishte në valutë të huaj dhe kryesisht në euro.

But the strengthening of the lek is giving a serious blow to the exporting sectors of goods and services in the economy. The drop in the euro exchange rate by almost 11% in one year translates into a decrease in income (as a result of exchange rate movements) to the same extent for those entities that realize all their income in euros.

For many businesses, amortization of such a blow will be difficult, given the still high pressures on the cost side, due to high inflation and salary increases./ Monitor

Latest news

Greece imposes fee to visit Santorini, how many euros tourists must pay

2025-07-03 20:50:37

Don't make fun of the highlanders, Elisa!

2025-07-03 20:43:43

Gunfire in Durres, a 30-year-old man is injured

2025-07-03 20:30:52

The recount in Fier cast doubt on the integrity of the vote

2025-07-03 20:09:03

Heatwave has left at least 9 dead this week in Europe

2025-07-03 19:00:01

Oil exploitation, Bankers accused of 20-year fraud scheme

2025-07-03 18:33:52

Three drinks that make you sweat less in the summer

2025-07-03 18:19:35

What we know so far about the deaths of Diogo Jota and his brother André Silva

2025-07-03 18:01:56

Another heat wave is expected to grip Europe

2025-07-03 17:10:58

Accident on Arbri Street, car goes off the road, two injured

2025-07-03 16:45:27

Accused of two murders, England says "NO" to Ilirjan Zeqaj's extradition

2025-07-03 16:25:05

Gaza rescue teams: Israeli forces killed 25 people, 12 in shelters

2025-07-03 15:08:43

Diddy's trial ends, producer denied bail

2025-07-03 15:02:41

Agricultural production costs are rising rapidly, 4.8% in 2024

2025-07-03 14:55:13

Warning signs of poor blood circulation

2025-07-03 14:49:47

Croatia recommends its citizens not to travel to Serbia

2025-07-03 14:31:19

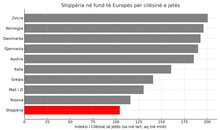

Berisha: Albania is the blackest stain in Europe for the export of emigrants

2025-07-03 14:20:19

'Ministry of Smoke': Activists Blame Government for Wasteland Fires

2025-07-03 13:59:09

AFF message of condolences for the tragic loss of Diogo Jota and his brother

2025-07-03 13:41:36

Five healthy foods you should add to your diet

2025-07-03 13:30:19

A unique summer season, full of rhythm and rewards for Credins bank customers!

2025-07-03 12:12:20

Fire situation in the country, 29 fires reported in 24 hours

2025-07-03 12:00:04

The constitution of the Kosovo Assembly fails for the 41st time

2025-07-03 11:59:57

The gendering of politics

2025-07-03 11:48:36

The price we pay after the "elections"

2025-07-03 11:25:39

Xhafa: The fire at the Elbasan landfill was deliberately lit to destroy evidence

2025-07-03 11:08:43

The 3 zodiac signs that will have financial growth during July

2025-07-03 10:48:01

Democratic MP talks about the incinerator, Spiropali turns off her microphone

2025-07-03 10:39:24

Ndahet nga jeta tragjikisht në moshën 28-vjeçare ylli i Liverpool, Diogo Jota

2025-07-03 10:21:03

Cocaine trafficking network in Greece, including Albanians, uncovered

2025-07-03 10:10:12

Korreshi: Election manipulation began long before the voting date

2025-07-03 09:39:13

Arrest of Greek customs officer 'paralyzes' vehicle traffic at Qafë Botë

2025-07-03 09:28:41

After Tirana and Fier, the boxes are opened in Durrës today

2025-07-03 09:21:10

Enea Mihaj transfers to the USA, will play as an opponent of Messi and Uzun

2025-07-03 09:10:04

Foreign exchange, the rate at which foreign currencies are sold and bought

2025-07-03 08:53:50

Index, Albania has the worst quality of life in Europe

2025-07-03 08:48:10

Horoscope, what do the stars have in store for you today?

2025-07-03 08:17:05

Clear weather and high temperatures, here's the forecast for this Thursday

2025-07-03 08:00:37

Posta e mëngjesit/ Me 2 rreshta: Çfarë pati rëndësi dje në Shqipëri

2025-07-03 07:46:48

Lufta në Gaza/ Pse Netanyahu do vetëm një armëpushim 60-ditor, jo të përhershëm?

2025-07-02 21:56:08

US suspends some military aid to Ukraine

2025-07-02 21:40:55

Methadone shortage, users return to heroin: We steal to buy it

2025-07-02 20:57:35

Government enters oil market, Rama: New price for consumers

2025-07-02 20:43:30

WHO calls for 50% price hike for tobacco, alcohol and sugary drinks

2025-07-02 20:41:53