Flash News

Flash News

Gunfire in Durres, a 30-year-old man is injured

Accident on Arbri Street, car goes off the road, two injured

Arrests of "Bankers Petrolium", Prosecution provides details: Exported and sold 532 billion lek of oil, caused millions of euros in damage to the state

Ndahet nga jeta tragjikisht në moshën 28-vjeçare ylli i Liverpool, Diogo Jota

Posta e mëngjesit/ Me 2 rreshta: Çfarë pati rëndësi dje në Shqipëri

The IRS (Tax Authority of the United States of America) reported in October 2023 a plan that aims to close the disparity for taxes paid.

The institution said it was working to increase the low audit rate for large corporations, complex partnerships and high-income individuals. The tax gap, or the difference between taxes owed and actually paid, was about $688 billion for the 2021 tax year, the IRS reported in October.

Over the past decade, global discussions of tax policy reform have moved away from a focus on the link between taxes and economic growth toward tax reform that takes into account equity and growth objectives.

In fact, the focus today in the world, especially after the Covid pandemic, is that tax policies can be designed comprehensively, so that fiscal systems can provide a balance of equality, growth and sustainability.

Tax policy also has an important role to play in increasing balance, through policies to address the distribution of income and wealth. The pressure is expected to increase in the future, due to the aging of the population and the effect of this trend on the labor market and the pension scheme.

In Albania, budget revenues have shown positive progress in the last two years and in 2023 they are estimated to have reached the highest historical level of 28.2% of the Gross Domestic Product (GDP).

But, in a detailed look, it is clear that the increase in income does not come from an expansion of the taxpayer base, high economic development, or a focus on high-income taxpayers. It comes from random and cyclical factors, such as changes in prices or wages.

In 2022, it was high prices that inflated budget revenues, especially from Value Added Tax and excise duty, which are taxes paid directly by the consumer in the final price of the product. In 2023, there was an increase in wages, driven by the reform in the administration and especially by the pressure that was created on businesses, as a result of the flight of the labor force to emigration.

From the official data, it appears that individuals are the ones who have had the main impact on the increase of income in the budget, through insurance payments and personal income tax.

About 34 billion ALL were collected from these two items, or almost half of the increase in budget income in 2023. The main burden was borne by people with low wages, as a result of the increase in the minimum wage, or the so-called middle class.

This increase, based on wages, is not sustainable for two reasons. First, it was done without an improvement in productivity, because it was not driven by the economy, but by pressure on employees.

Second, in a chain effect, the forced intervention in employee compensation, not accompanied by efficiency, is not creating room for further wage growth, causing the effect to fade quickly, starting in April.

On the other hand, the pressure on businesses and individuals who do not pay taxes does not seem to be high. The data of the annual tax report for 2023 showed that the unpaid obligations of businesses and individuals to the fiscal administration are increasing year after year, despite the fact that there are already consolidated structures for their collection.

Official data indicates that on December 31, 2023, tax liabilities were over 155 billion ALL (1.5 billion euros), with an increase of 6%.

During the last year, the tax debt recorded a net increase of 8.4 billion lek compared to the beginning of the year (this amount is as much as 12% of the total revenue increase in 2023). Businesses do not pay VAT, profit tax, or social security of their employees.

Fiscal policies after the 1990s have oscillated considerably between the initial need of the early 1990s to allow businesses to revive and individuals to start accumulating savings and the need to reduce the informal economy and improve revenue collection performance budgetary.

Applied to an economic environment that inherited a culture of "theoretical non-payment of taxes" before the 1990s, since in reality the "surplus value" accumulated by the centralized economy was high, the results of fiscal policies in the years after the 1990s did not win durability feature and harmonious structure.

Also accompanied by problematic implementation in practice, translated into the effectiveness of tax bodies, widespread corruption and unsatisfactory quality of services supported by tax revenues, any changes in fiscal packages, which have been frequent, have not produce lasting and irreversible results.

The same trend is being emphasized especially in recent years, where in order to improve the performance of the indicators, the easiest way of increasing the tax burden has been found, in the name of equality, where more inequality is being caused, without daring to fundamentally intervene in the administration of income and in the effectiveness of the army of the tax-collecting and tax-spending administration./ Monitor

Latest news

Greece imposes fee to visit Santorini, how many euros tourists must pay

2025-07-03 20:50:37

Don't make fun of the highlanders, Elisa!

2025-07-03 20:43:43

Gunfire in Durres, a 30-year-old man is injured

2025-07-03 20:30:52

The recount in Fier cast doubt on the integrity of the vote

2025-07-03 20:09:03

Heatwave has left at least 9 dead this week in Europe

2025-07-03 19:00:01

Oil exploitation, Bankers accused of 20-year fraud scheme

2025-07-03 18:33:52

Three drinks that make you sweat less in the summer

2025-07-03 18:19:35

What we know so far about the deaths of Diogo Jota and his brother André Silva

2025-07-03 18:01:56

Another heat wave is expected to grip Europe

2025-07-03 17:10:58

Accident on Arbri Street, car goes off the road, two injured

2025-07-03 16:45:27

Accused of two murders, England says "NO" to Ilirjan Zeqaj's extradition

2025-07-03 16:25:05

Gaza rescue teams: Israeli forces killed 25 people, 12 in shelters

2025-07-03 15:08:43

Diddy's trial ends, producer denied bail

2025-07-03 15:02:41

Agricultural production costs are rising rapidly, 4.8% in 2024

2025-07-03 14:55:13

Warning signs of poor blood circulation

2025-07-03 14:49:47

Croatia recommends its citizens not to travel to Serbia

2025-07-03 14:31:19

Berisha: Albania is the blackest stain in Europe for the export of emigrants

2025-07-03 14:20:19

'Ministry of Smoke': Activists Blame Government for Wasteland Fires

2025-07-03 13:59:09

AFF message of condolences for the tragic loss of Diogo Jota and his brother

2025-07-03 13:41:36

Five healthy foods you should add to your diet

2025-07-03 13:30:19

A unique summer season, full of rhythm and rewards for Credins bank customers!

2025-07-03 12:12:20

Fire situation in the country, 29 fires reported in 24 hours

2025-07-03 12:00:04

The constitution of the Kosovo Assembly fails for the 41st time

2025-07-03 11:59:57

The gendering of politics

2025-07-03 11:48:36

The price we pay after the "elections"

2025-07-03 11:25:39

Xhafa: The fire at the Elbasan landfill was deliberately lit to destroy evidence

2025-07-03 11:08:43

The 3 zodiac signs that will have financial growth during July

2025-07-03 10:48:01

Democratic MP talks about the incinerator, Spiropali turns off her microphone

2025-07-03 10:39:24

Ndahet nga jeta tragjikisht në moshën 28-vjeçare ylli i Liverpool, Diogo Jota

2025-07-03 10:21:03

Cocaine trafficking network in Greece, including Albanians, uncovered

2025-07-03 10:10:12

Korreshi: Election manipulation began long before the voting date

2025-07-03 09:39:13

Arrest of Greek customs officer 'paralyzes' vehicle traffic at Qafë Botë

2025-07-03 09:28:41

After Tirana and Fier, the boxes are opened in Durrës today

2025-07-03 09:21:10

Enea Mihaj transfers to the USA, will play as an opponent of Messi and Uzun

2025-07-03 09:10:04

Foreign exchange, the rate at which foreign currencies are sold and bought

2025-07-03 08:53:50

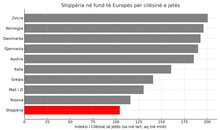

Index, Albania has the worst quality of life in Europe

2025-07-03 08:48:10

Horoscope, what do the stars have in store for you today?

2025-07-03 08:17:05

Clear weather and high temperatures, here's the forecast for this Thursday

2025-07-03 08:00:37

Posta e mëngjesit/ Me 2 rreshta: Çfarë pati rëndësi dje në Shqipëri

2025-07-03 07:46:48

Lufta në Gaza/ Pse Netanyahu do vetëm një armëpushim 60-ditor, jo të përhershëm?

2025-07-02 21:56:08

US suspends some military aid to Ukraine

2025-07-02 21:40:55

Methadone shortage, users return to heroin: We steal to buy it

2025-07-02 20:57:35

Government enters oil market, Rama: New price for consumers

2025-07-02 20:43:30

WHO calls for 50% price hike for tobacco, alcohol and sugary drinks

2025-07-02 20:41:53