Flash News

Flash News

Gunfire in Durres, a 30-year-old man is injured

Accident on Arbri Street, car goes off the road, two injured

Arrests of "Bankers Petrolium", Prosecution provides details: Exported and sold 532 billion lek of oil, caused millions of euros in damage to the state

Ndahet nga jeta tragjikisht në moshën 28-vjeçare ylli i Liverpool, Diogo Jota

Posta e mëngjesit/ Me 2 rreshta: Çfarë pati rëndësi dje në Shqipëri

The non-performing loan ratio fell for the eighth consecutive year in 2024

The non-performing loan ratio fell for the eighth consecutive year in 2024. According to data from the Bank of Albania, the non-performing loan ratio fell to 4.17%, from 4.74% a year earlier. This indicator has reached its lowest level since September 2008.

As is usually the case, December brought a larger decline compared to previous months of the year. This is because banks clean up their portfolios of lost loans before the end of the financial year, but the significant expansion of the total loan portfolio, by 11 billion lek more compared to November, may have also had an impact.

It is precisely the increase in the total loan portfolio that has played an important role in reducing the ratio of non-performing loans last year.

The loan portfolio for the economy at the end of 2024 reached the value of 835.6 billion lek, an annual increase of 12.3%. This is also the highest growth of the loan portfolio for the economy in the last 16 years.

The Albanian economy last year was characterized by relatively high growth rates, supported especially by the good performance of sectors related to tourism and real estate.

Over the past year, the ratio of non-performing loans has also decreased slightly in absolute terms. Total non-performing loans at the end of 2024 are estimated at approximately 34.8 billion lek, down from approximately 35.3 billion lek a year earlier. In absolute terms, bad loans have decreased by approximately 0.5 billion lek or 1.4% compared to a year earlier.

The year 2024 also brought a continuation of the multi-year downward trend in the ratio of non-performing loans, but nevertheless the rapid growth of credit, especially in the real estate sector, has raised concerns at the Bank of Albania. Last year, the real estate loan portfolio of individuals and businesses increased by 15.5% and 17.4%, respectively.

Taken together, these portfolios comprise approximately half of the total value of credit provided by the domestic banking sector.

Last year, the Central Bank decided to apply a countercyclical surcharge to the banking sector's capital adequacy ratio for the first time. Initially, the required capital adequacy ratio was increased by 0.25% in June, while in December Governor Sejko decided on a second increase, bringing the countercyclical surcharge to 0.5%./Monitor

Latest news

Greece imposes fee to visit Santorini, how many euros tourists must pay

2025-07-03 20:50:37

Don't make fun of the highlanders, Elisa!

2025-07-03 20:43:43

Gunfire in Durres, a 30-year-old man is injured

2025-07-03 20:30:52

The recount in Fier cast doubt on the integrity of the vote

2025-07-03 20:09:03

Heatwave has left at least 9 dead this week in Europe

2025-07-03 19:00:01

Oil exploitation, Bankers accused of 20-year fraud scheme

2025-07-03 18:33:52

Three drinks that make you sweat less in the summer

2025-07-03 18:19:35

What we know so far about the deaths of Diogo Jota and his brother André Silva

2025-07-03 18:01:56

Another heat wave is expected to grip Europe

2025-07-03 17:10:58

Accident on Arbri Street, car goes off the road, two injured

2025-07-03 16:45:27

Accused of two murders, England says "NO" to Ilirjan Zeqaj's extradition

2025-07-03 16:25:05

Gaza rescue teams: Israeli forces killed 25 people, 12 in shelters

2025-07-03 15:08:43

Diddy's trial ends, producer denied bail

2025-07-03 15:02:41

Agricultural production costs are rising rapidly, 4.8% in 2024

2025-07-03 14:55:13

Warning signs of poor blood circulation

2025-07-03 14:49:47

Croatia recommends its citizens not to travel to Serbia

2025-07-03 14:31:19

Berisha: Albania is the blackest stain in Europe for the export of emigrants

2025-07-03 14:20:19

'Ministry of Smoke': Activists Blame Government for Wasteland Fires

2025-07-03 13:59:09

AFF message of condolences for the tragic loss of Diogo Jota and his brother

2025-07-03 13:41:36

Five healthy foods you should add to your diet

2025-07-03 13:30:19

A unique summer season, full of rhythm and rewards for Credins bank customers!

2025-07-03 12:12:20

Fire situation in the country, 29 fires reported in 24 hours

2025-07-03 12:00:04

The constitution of the Kosovo Assembly fails for the 41st time

2025-07-03 11:59:57

The gendering of politics

2025-07-03 11:48:36

The price we pay after the "elections"

2025-07-03 11:25:39

Xhafa: The fire at the Elbasan landfill was deliberately lit to destroy evidence

2025-07-03 11:08:43

The 3 zodiac signs that will have financial growth during July

2025-07-03 10:48:01

Democratic MP talks about the incinerator, Spiropali turns off her microphone

2025-07-03 10:39:24

Ndahet nga jeta tragjikisht në moshën 28-vjeçare ylli i Liverpool, Diogo Jota

2025-07-03 10:21:03

Cocaine trafficking network in Greece, including Albanians, uncovered

2025-07-03 10:10:12

Korreshi: Election manipulation began long before the voting date

2025-07-03 09:39:13

Arrest of Greek customs officer 'paralyzes' vehicle traffic at Qafë Botë

2025-07-03 09:28:41

After Tirana and Fier, the boxes are opened in Durrës today

2025-07-03 09:21:10

Enea Mihaj transfers to the USA, will play as an opponent of Messi and Uzun

2025-07-03 09:10:04

Foreign exchange, the rate at which foreign currencies are sold and bought

2025-07-03 08:53:50

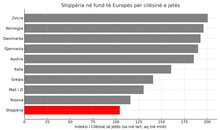

Index, Albania has the worst quality of life in Europe

2025-07-03 08:48:10

Horoscope, what do the stars have in store for you today?

2025-07-03 08:17:05

Clear weather and high temperatures, here's the forecast for this Thursday

2025-07-03 08:00:37

Posta e mëngjesit/ Me 2 rreshta: Çfarë pati rëndësi dje në Shqipëri

2025-07-03 07:46:48

Lufta në Gaza/ Pse Netanyahu do vetëm një armëpushim 60-ditor, jo të përhershëm?

2025-07-02 21:56:08

US suspends some military aid to Ukraine

2025-07-02 21:40:55

Methadone shortage, users return to heroin: We steal to buy it

2025-07-02 20:57:35

Government enters oil market, Rama: New price for consumers

2025-07-02 20:43:30

WHO calls for 50% price hike for tobacco, alcohol and sugary drinks

2025-07-02 20:41:53