Flash News

Flash News

Gunfire in Durres, a 30-year-old man is injured

Accident on Arbri Street, car goes off the road, two injured

Arrests of "Bankers Petrolium", Prosecution provides details: Exported and sold 532 billion lek of oil, caused millions of euros in damage to the state

Ndahet nga jeta tragjikisht në moshën 28-vjeçare ylli i Liverpool, Diogo Jota

Posta e mëngjesit/ Me 2 rreshta: Çfarë pati rëndësi dje në Shqipëri

Problems of investment funds and pensions in conditions of increased interest

Artan Gjergji

For anyone who carefully and professionally follows the development, quite intense and fluctuating, of the international financial markets, but also in the country, he cannot have escaped without noticing the big and immediate problem that caused the British financial market the movement in contrast to the Bank of England (central bank), which in a strong move injected around 65 billion pounds over a 13-day period (every day of 5 billion). Despite accusations and conjectures that it was making the wrong move in the conditions of an inflationary period when central banks try to withdraw liquidity from the market by increasing interest rates in order to curb inflation, the Central Bank surprised everyone with statements that it was trying to maintain the financial stability of the entire architecture,

What had happened? Mainly investment and pension funds, which invest a good part of their assets from citizens' savings in debt instruments (government and private), have felt an extraordinary pressure, hemorrhage, with citizens withdrawing their savings. This is because the increase in interest rates makes the returns from these financial instruments very unfavorable, bringing a noticeable decline in the profit curve from these schemes, and creating panic among citizens, even though this is a normal process in the financial markets. Even in those cases when citizens know the financial markets and know that this is a normal process, in the conditions of an inflation rate approaching 10%, a rate of return on investments that do not exceed the level of 5% makes this form of investment unfavorable for those who know capital markets and the philosophy of return on investments. Under pressure from citizens to exit funds and turn their positions into cash, investment and pension funds turn to stock exchanges to sell the securities they hold in their portfolios and create liquidity to respond to investors' demands in real-time. These strong movements bring huge losses for the funds. Securities are at best sold at very unfavorable prices in conditions of panic and pressure, or at worst are illiquid as they do not find investors. Under pressure from citizens to exit funds and turn their positions into cash, investment and pension funds turn to stock exchanges to sell the securities they hold in their portfolios and create liquidity to respond to investors' demands in real-time. These strong movements bring huge losses for the funds. Securities are at best sold at very unfavorable prices in conditions of panic and pressure, or at worst are illiquid as they do not find investors. Under pressure from citizens to exit funds and turn their positions into cash, investment and pension funds turn to stock exchanges to sell the securities they hold in their portfolios and create liquidity to respond to investors' demands in real-time. These strong movements bring huge losses for the funds. Securities are at best sold at very unfavorable prices in conditions of panic and pressure, or at worst are illiquid as they do not find investors.

For this reason, caught between 2 great evils in the financial market, panic and the risk of collapsing pension and investment schemes, as opposed to curbing or postponing in time the fight to reduce inflation, the Bank of England was forced to fight the worst of the biggest save from collapse funds. To this end, with a fairly aggressive package, it was forced to buy back (buy-back) British treasury bonds (guilts) from pension funds in need of liquidity, and save them from the hemorrhaging pressure that comes mainly due to of financial panic. Later, the Central Bank will return to the fight to curb inflation. Of course, this situation was not at all helped by the fragile political situation in the British Government,

A more or less similar concern is raised by the IMF in a recent report, which analyzes the direct link that tight monetary policies (increasing interest rates) have in the conditions of the fight to curb inflation in other segments of the financial market such as investment and pension funds. According to this study (graph below), there is an inverse relationship between the increase in rates of return from funds exposed to debt securities, or other non-liquid assets, and the increase in interest rates that are being applied by central banks. Precisely according to the IMF, the regulators must take the utmost care for an interweaving of policies, in such a way that the costs are as low as possible and do not cause strong impacts or further collapse of certain segments of the financial market.

Where is Albania in the meantime?

Undoubtedly, the economic doctrine and the logic of the operation of traditional financial markets work equally everywhere. As a result, investment funds in the country have suffered a decline in the curve of return rates. This phenomenon is not the fault of the administration of these funds (it must be said that undoubtedly all funds in Albania have an administration based on modern professional bases). The decrease in return rates comes from the fact that most of the assets of these funds are exposed to debt securities. The increase in interest rates has a negative impact on the prices (value) of securities, bringing about their devaluation. Under normal conditions, similar funds in developed markets maneuver quickly by selling part of the portfolios and replacing them with other financial instruments, thus enabling an amortization of an unfavorable and temporary situation. But, unfortunately for us, the modest development of the capital market in Albania does not offer many alternatives other than debt instruments, therefore the possibilities of funds to amortize the negative effects are extremely limited.

The good news is that, due to legislative restrictions and the embryonic stage of pension funds, it is not allowed to exit or close investment positions from pension funds. In other words, pension fund contributors cannot withdraw (without penalty) from pension funds for periods of time shorter than 10 years. This legal criterion has prevented the hemorrhaging of pension funds, giving these institutions the opportunity to amortize the problem that comes from the market and extend the recovery period to a longer period time. However, it must be said that the rate of return from pension and investment funds in Albania, as in the whole world, is far below the rate of inflation, which makes these instruments temporarily unfavorable.

Consequently, Albania needs the rapid development of the capital market, as a very important segment of the financial market, which regulates not only a better administration of pension funds and investments but also helps a faster follow-up and the efficiency of the monetary policy played by the Central Bank in the country's economy.

Latest news

Greece imposes fee to visit Santorini, how many euros tourists must pay

2025-07-03 20:50:37

Don't make fun of the highlanders, Elisa!

2025-07-03 20:43:43

Gunfire in Durres, a 30-year-old man is injured

2025-07-03 20:30:52

The recount in Fier cast doubt on the integrity of the vote

2025-07-03 20:09:03

Heatwave has left at least 9 dead this week in Europe

2025-07-03 19:00:01

Oil exploitation, Bankers accused of 20-year fraud scheme

2025-07-03 18:33:52

Three drinks that make you sweat less in the summer

2025-07-03 18:19:35

What we know so far about the deaths of Diogo Jota and his brother André Silva

2025-07-03 18:01:56

Another heat wave is expected to grip Europe

2025-07-03 17:10:58

Accident on Arbri Street, car goes off the road, two injured

2025-07-03 16:45:27

Accused of two murders, England says "NO" to Ilirjan Zeqaj's extradition

2025-07-03 16:25:05

Gaza rescue teams: Israeli forces killed 25 people, 12 in shelters

2025-07-03 15:08:43

Diddy's trial ends, producer denied bail

2025-07-03 15:02:41

Agricultural production costs are rising rapidly, 4.8% in 2024

2025-07-03 14:55:13

Warning signs of poor blood circulation

2025-07-03 14:49:47

Croatia recommends its citizens not to travel to Serbia

2025-07-03 14:31:19

Berisha: Albania is the blackest stain in Europe for the export of emigrants

2025-07-03 14:20:19

'Ministry of Smoke': Activists Blame Government for Wasteland Fires

2025-07-03 13:59:09

AFF message of condolences for the tragic loss of Diogo Jota and his brother

2025-07-03 13:41:36

Five healthy foods you should add to your diet

2025-07-03 13:30:19

A unique summer season, full of rhythm and rewards for Credins bank customers!

2025-07-03 12:12:20

Fire situation in the country, 29 fires reported in 24 hours

2025-07-03 12:00:04

The constitution of the Kosovo Assembly fails for the 41st time

2025-07-03 11:59:57

The gendering of politics

2025-07-03 11:48:36

The price we pay after the "elections"

2025-07-03 11:25:39

Xhafa: The fire at the Elbasan landfill was deliberately lit to destroy evidence

2025-07-03 11:08:43

The 3 zodiac signs that will have financial growth during July

2025-07-03 10:48:01

Democratic MP talks about the incinerator, Spiropali turns off her microphone

2025-07-03 10:39:24

Ndahet nga jeta tragjikisht në moshën 28-vjeçare ylli i Liverpool, Diogo Jota

2025-07-03 10:21:03

Cocaine trafficking network in Greece, including Albanians, uncovered

2025-07-03 10:10:12

Korreshi: Election manipulation began long before the voting date

2025-07-03 09:39:13

Arrest of Greek customs officer 'paralyzes' vehicle traffic at Qafë Botë

2025-07-03 09:28:41

After Tirana and Fier, the boxes are opened in Durrës today

2025-07-03 09:21:10

Enea Mihaj transfers to the USA, will play as an opponent of Messi and Uzun

2025-07-03 09:10:04

Foreign exchange, the rate at which foreign currencies are sold and bought

2025-07-03 08:53:50

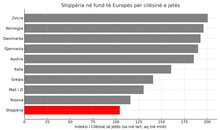

Index, Albania has the worst quality of life in Europe

2025-07-03 08:48:10

Horoscope, what do the stars have in store for you today?

2025-07-03 08:17:05

Clear weather and high temperatures, here's the forecast for this Thursday

2025-07-03 08:00:37

Posta e mëngjesit/ Me 2 rreshta: Çfarë pati rëndësi dje në Shqipëri

2025-07-03 07:46:48

Lufta në Gaza/ Pse Netanyahu do vetëm një armëpushim 60-ditor, jo të përhershëm?

2025-07-02 21:56:08

US suspends some military aid to Ukraine

2025-07-02 21:40:55

Methadone shortage, users return to heroin: We steal to buy it

2025-07-02 20:57:35

Government enters oil market, Rama: New price for consumers

2025-07-02 20:43:30

WHO calls for 50% price hike for tobacco, alcohol and sugary drinks

2025-07-02 20:41:53