Flash News

Flash News

Korça/ 40-year-old man jumps from fifth floor balcony, in critical condition

Croatia restores compulsory military service

Illegal constructions in Theth, Manja demands disciplinary proceedings against prosecutor Elsa Gjeli

Details from the murder of Renis Dobra, the perpetrators came with 2 Range Rover cars from Rrëshen

The Supreme Court left him in prison, Meta addresses the 'Constitution'

The EU reveals the international VAT fraud scheme worth 2.2 billion euros, Albania is also a part of it

The European Public Prosecutor's Office (EPPO) announced on Tuesday that it had uncovered the largest cross-border VAT fraud scheme ever investigated in the EU worth around €2.2 billion.

The investigation began in April 2021 in Portugal, where authorities were investigating a company that sold mobile phones, tablets, headphones and other electronic devices, on suspicion of VAT fraud.

As requested by them, the Portuguese authorities reported the case to the EPPO after its launch in June 2021, despite the initial investigation finding everything in order.

But additional digging by European prosecutors, financial fraud analysts, Europol and national law enforcement authorities quickly established links between the Portuguese companies and nearly 9,000 other legal entities and more than 600 individuals.

These were located in most EU countries, as well as in Albania, China, Mauritius, Serbia, Singapore, Switzerland, Turkey, the United Arab Emirates, the United Kingdom and the United States.

Searches were carried out in six EU member states in mid-October with a further 200 searches executed in 14 other EU countries on Tuesday.

"All data collected is being analyzed and the investigation into the organized crime groups behind this scheme is ongoing," the EPPO said in a statement.

"The estimated damages investigated under Operation Admiral currently amount to 2.2 billion euros. Measures have been taken to recover the damages, " the statement said.

According to the EU agency, the case is worthy of attention not only because of its large scale, but also because of the "extraordinary complexity of the chain of companies" involved.

"These activities would not be possible without the involvement of several highly skilled organized crime groups, each of which has specific roles in the overall scheme. Working internationally, almost with an industrial logic, they have for years avoid detection," the prosecution said.

Such fraud is the most profitable crime in the bloc and is estimated to cost EU states €50 billion a year in tax losses.

"Operation Admiral is a clear demonstration of the advantages of a transnational prosecution," said European Chief Prosecutor Laura Kövesi.

"When it comes to VAT fraud, from a national perspective, the damages can be assessed as relatively small or non-existent, or even go undetected. It takes a helicopter view to see the whole picture," she added.

Latest news

Malltezi: SPAK admits, we are in a process that began with Balla's false report

2025-07-10 22:34:16

Si të çliroheni nga bllokimet emocionale me anë të ushtrimeve

2025-07-10 21:57:24

Lala: Veliaj wanted to return as mayor

2025-07-10 21:40:46

VIDEO/ Brawl in Bolivian parliament, deputies physically clash

2025-07-10 21:20:30

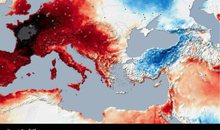

Albania experienced one of the longest heat waves of the last decade

2025-07-10 21:01:09

The Government approves new procedures for declaring residence in e-Albania

2025-07-10 20:39:32

Koka: Northerners will not forget Edi Rama's racist operation in Theth

2025-07-10 20:18:24

The 3 zodiac signs that will be most affected by the 'Full Moon' of July 10

2025-07-10 20:04:49

New director of the National Center of Cinematography appointed

2025-07-10 19:51:12

Korça/ 40-year-old man jumps from fifth floor balcony, in critical condition

2025-07-10 19:40:19

'Tired Woman'/ The Syndrome That Affects Thousands of Women Every Day

2025-07-10 19:34:02

Jane Birkin's original Hermès bag sells for $10 million

2025-07-10 19:26:22

Britain-Ukraine agreement signed for 5,000 Thales missiles

2025-07-10 19:00:25

Fire in Zvërnec, flames endanger two hotels

2025-07-10 18:57:19

Croatia restores compulsory military service

2025-07-10 18:39:01

Spahia: The great truth of the strong accusation of the residents of Theth

2025-07-10 18:35:07

The Supreme Court left him in prison, Meta addresses the 'Constitution'

2025-07-10 17:57:21

New punishment with 'new' regulations

2025-07-10 17:54:46

EU translator fired over fears for Zelenskyy's safety

2025-07-10 17:45:37

'You are a policeman, but not God, take my soul', protest for Agon Zejnullahu

2025-07-10 17:41:21

Video/ Rama repeats the scenario, kneels before Meloni again

2025-07-10 16:56:31

He set fire to a plot of olive trees, 50-year-old man arrested in Shijak

2025-07-10 16:46:19

Rubio: US and Russia have exchanged new ideas for Ukraine peace talks

2025-07-10 16:36:20

Death of 27-year-old, Lipjan Police Commander Resigns

2025-07-10 16:21:28

Video/ An apartment burns in Tirana near the New Bazaar

2025-07-10 16:09:36

Jensila lights up the internet with her birthday greetings to Ledri

2025-07-10 15:42:08

They're full of pesticides! List of 12 products we need to be careful of

2025-07-10 15:31:04

Worker falls from scaffolding in Shëngjin, urgently sent to Trauma

2025-07-10 15:11:03

Malltezi: Within one day they seized my accounts, properties and shares

2025-07-10 15:01:23

EU: Israel has agreed to more aid to Gaza

2025-07-10 14:55:19

Murder of Reni Dobra, 23-year-old's vehicle pulled from the water

2025-07-10 14:29:23

Trump's tariffs on Brazil raise coffee prices

2025-07-10 14:16:07

Ursula von der Leyen survives no-confidence vote

2025-07-10 14:04:27

Fire in Lezha, flames near electrical substation

2025-07-10 13:32:24

Residents clash with police in Theth, a woman faints

2025-07-10 13:24:38

"Rama and Xanun"

2025-07-10 13:15:46

Zodiac signs most likely to get divorced in July 2025

2025-07-10 12:45:51

A scapegoat for an illegitimate Republic

2025-07-10 12:35:02

"He has devastated his own nation"/ Berisha: Rama imprisons his opponents!

2025-07-10 12:26:54

Albanian man injured with knife in Italy

2025-07-10 12:08:55

23-year-old in Mat drowned with rope, 4 suspects are being held

2025-07-10 10:58:53

After the dismissals, the new director of the Shkodra Police is appointed

2025-07-10 10:30:10

BIRN: Rama's action for public spaces, a repeated spectacle

2025-07-10 10:29:11

Action in Theth, Shkodra Police leaders dismissed

2025-07-10 10:16:28

Fatal accident on the Tirana-Durres highway

2025-07-10 10:01:58

The incinerator does not exist, but the government continues to increase funds

2025-07-10 09:51:45

Albania is aging at a rapid pace! 30% of the population is over 60 years old

2025-07-10 09:46:23

End of an era, Modric says 'goodbye' to Real Madrid

2025-07-10 09:36:09

Mount Dukat has been on fire for 6 days, residents request air intervention

2025-07-10 09:27:24

"Poverty on the rise"/ DW: Many people in Germany are not getting paid

2025-07-10 09:08:06

Horoscope, what do the stars have in store for you today?

2025-07-10 08:51:59

The scorching heat returns, the thermometer climbs to 40°C

2025-07-10 07:58:52

Morning Post/ In 2 lines: What mattered yesterday in Albania

2025-07-10 07:46:35

Tourist operator in Theth: They are demolishing our houses without warning

2025-07-09 22:54:57

Trump and Israeli commander warn: Gaza ceasefire could be near

2025-07-09 22:13:21

Fire in Elbasan Landfill, pedagogue: It is a cancer and environmental crime

2025-07-09 21:54:47

Dangerous summer, number of snake bites increases

2025-07-09 21:22:13

Berisha appeals again: Stop state terror against the residents of Theth!

2025-07-09 21:15:36

'Kissing disease' virus linked to several forms of cancer

2025-07-09 21:04:44

Malltezi confesses after release: Justice has become a political weapon

2025-07-09 20:51:48

Vokshi: Albania's EU integration has stalled due to lack of free elections

2025-07-09 20:37:21