Flash News

Flash News

Korça/ 40-year-old man jumps from fifth floor balcony, in critical condition

Croatia restores compulsory military service

Illegal constructions in Theth, Manja demands disciplinary proceedings against prosecutor Elsa Gjeli

Details from the murder of Renis Dobra, the perpetrators came with 2 Range Rover cars from Rrëshen

The Supreme Court left him in prison, Meta addresses the 'Constitution'

Refund of prepaid tax by freelancers, Accountants: Liability for compensation

There are many self-employed businesses waiting for the return of prepaid amounts for the 15% tax, as a decision on this has not yet been made by the institutions even after the decision of the Constitutional Court.

According to the accountants, for professions exempted by the tax administration, assessments with the amount of zero lek should be sent.

Accountant Sotiraq Dhamo says that this automatically reflects in the system a credit surplus for the entities that have prepaid and further compensations are made for other obligations, except for social and health insurance.

On the contrary, the entities must apply for compensation to the Tax Appeal and then to the Administrative Court.

Even for the deputy of the Democratic Party, Jorida Tabaku, it is the obligation of the tax administration to immediately return the prepaid amounts after the decision of the Constitutional Court.

Ms. Tabaku says that in order not to delay the procedures for returning the prepaid amounts, the DP parliamentary group will propose a Normative Act to resolve this situation.

Earlier, various jurists familiar with the court case of lawsuits for free professions, affirmed that the prepaid amount is an obligation to be returned, with the entry into force of the Constitutional Court's decision.

According to them, the law "On tax procedures" clearly defines the compensation procedures for cases of credit surplus.

Accountants: Tax administration obligation to send notice of credit balance assessments

Accountant Sotiraq Dhamo told "Monitor" that as the changes made the tax zero for the free professions, the tax administration should immediately issue an assessment notice for the return of the prepaid amounts after the decision of the Constitutional Court.

"In order to return the prepaid amounts, in the first place, the notification for the new installment with a value of 0 must be issued.

For prepayments and corrections, according to general instruction no. 26, dated 8.9.2023 "On income tax", the tax administration must send new notifications for installments and profit tax for 2024, for this category that benefits from the Decision of the Constitutional Court.

These new notifications are added to the tax system. Automatically, those who have paid you will be overpaid, i.e. with a credit surplus.

And according to the law, the prepaid amount must be returned to them within 30 days at most", he says.

So what are the new revaluation notices? Accountant Dhamo explains that this is an obligation of Taxes to send, since the notice of the assessment of profit tax installments has been sent to be prepaid for the first months of 2024.

Now the profit tax has changed and it becomes 0, the Tax Administration must resend the notification of the assessment of the installments with the amount of 0 ALL.

Sipas tij dërgimit të njoftim vlerësimeve për tepricë kreditore, tatimet bëjnë menjëherë vetë kompensimin me detyrimet për tatimet, përveç sigurimeve që mund të ketë subjekti.

Në të kundërt me kërkesë të subjektit, shumta e parapaguara duhet maksimumi të kthehen brenda 30 ditëve.

Z. Dhamo thotë se nuk kthehen shumat e parapaguara,tatimpaguesit do të duhet fillimisht t’u drejtohen Apelimit Tatimor pastaj Gjykatës Administrative.

Çfarë parashikon udhëzimi i përgjithshëm nr. 26, datë 8.9.2023 “Për tatimin mbi të ardhurat” për parapagimet dhe korrigjimet ?

63.1 Llogaritja e kësteve të parapagimit gjatë vitit tatimor për tatimin mbi fitimin korporativ Tatimpaguesi subjekt i tatimit mbi fitimin korporativ, gjatë vitit tatimor, parapaguan këstet mujore/tremujore të tatimit mbi fitimin:

– brenda datës 31 mars, për muajt janar, shkurt, mars;

– brenda datës 30 qershor, për muajt prill, maj, qershor;

– brenda datës 30 shtator, për muajt korrik, gusht, shtator; dhe

– brenda datës 31 dhjetor, për muajt tetor, nëntor dhjetor.

Bazuar në të dhënat e deklaratës së fitimit të tatueshëm të vitit paraardhës, të dorëzuar nga tatimpaguesi, deklaratë që duhet të dorëzohet brenda datës 31 mars të vitit vijues, administrata tatimore llogarit këstet mujore dhe ato tremujore të parapagimeve të tatimit mbi fitimin korporativ për periudhën prill–dhjetor të vitit vijues dhe për periudhën janar–mars të vitit të ardhshëm.

Këstet e parapagimeve i njoftohen tatimpaguesit në rrugë elektronike në llogarinë e tij brenda datës 10 prill të vitit vijues. Këstet e llogaritura të parapagimeve paguhen nga tatimpaguesi në fund të çdo 3-mujori, por mund të paguhen edhe në bazë mujore, brenda datës 15 të çdo muaji. Kur këstet e parapagimeve paguhen në bazë tremujore, kësti i çdo tremujori llogaritet si shumë e kësteve të çdo muaji të tremujorit përkatës.

63.3 Korrigjimi në ulje i kësteve mujore të paradhënieve të tatimit mbi fitimin korporativ.

Tatimpaguesi, në çdo muaj gjatë periudhës tatimore mund të kërkojë dhe të provojë para organeve tatimore se tatimi mbi fitimin për këtë periudhë tatimore do të jetë, në mënyrë domethënëse, më i ulët se tatimi mbi fitimin në periudhën paraardhëse ose periudhën e dytë paraardhëse.

Në këto raste organi tatimor, bazuar në argumentet, dokumentacionin dhe të evidencat e tatimpaguesit, zvogëlojnë shumat e llogaritura të parapagimeve.

Argumentet që mund të parashtrojë tatimpaguesi për të kërkuar reduktimin/heqjen e kësteve të llogaritura të parapagimit janë:

– Kur shitjet e deklaruara në 3 muajt e fundit, para kërkesës për reduktim të kësteve janë ulur me mbi 20% krahasuar me shitjet mesatare mujore të 12-mujorit të fundit para këtij 3-mujori. Reduktimi i kësteve bëhet në proporcion me reduktimin e shitjeve të mallrave dhe të shërbimeve.

– When the purchases declared in the last 3 months have decreased by more than 30% compared to the average monthly purchases of the last 12 months before this 3 months. The reduction of installments for prepayments is done in proportion to the reduction of purchases of goods and services.

- When there is a lack of contracts for the sale of goods or services, work contracts, etc., which will significantly reduce the activity and income of the taxpayer for the remaining months of the following year, for which the reduction of monthly installments of income tax prepayments.

- When the contracts on the basis of which the income was realized in the previous years are completed, the facilities or other contracted public works have been completed.

- When disasters or damages have occurred in the taxpayer's activity during the following year and that will lead to a significant reduction in economic activity.

– When certain lines and activities are closed, the work force is significantly reduced, etc., as a result of the contraction of the activity. In cases where the conditions on the basis of which the installments of advance payments were reduced have changed, the tax administration reviews them in increments.

Tabaku: The Court's decision is binding. We will propose a Normative Act for the return of prepaid amounts

About 10 million euros is the obligation unfairly prepaid by the free professions according to the deputy of the Democratic Party, Jorida Tabaku, a lot that according to her is the obligation of the tax administration to return to businesses after the decision of the Constitutional Court

Ms. Tabaku told "Monitor" that in order not to delay the procedures of returning the prepaid amounts, the DP parliamentary group will propose a Normative Act to solve this situation.

"The law will necessarily have to reflect the change that was established in the article of transitional provisions.

And the change will have to be made immediately. In the same place, it is stated that the payments made are treated according to the article of Overpaid Obligations of the law "On Tax Procedures".

The return of prepaid obligations was also requested, by law, this cannot be avoided by the institutions.

I don't know if the Minister has a predisposition to solve it with an Order of his own. Do not delay or lead to a dead end in the procedure. It is an unprecedented situation.

The amended law seals everything. Meanwhile, we are also looking at the Code of Administrative Procedures", she asserted./Monitor

Latest news

Malltezi: SPAK admits, we are in a process that began with Balla's false report

2025-07-10 22:34:16

Si të çliroheni nga bllokimet emocionale me anë të ushtrimeve

2025-07-10 21:57:24

Lala: Veliaj wanted to return as mayor

2025-07-10 21:40:46

VIDEO/ Brawl in Bolivian parliament, deputies physically clash

2025-07-10 21:20:30

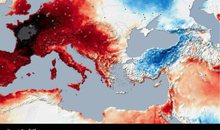

Albania experienced one of the longest heat waves of the last decade

2025-07-10 21:01:09

The Government approves new procedures for declaring residence in e-Albania

2025-07-10 20:39:32

Koka: Northerners will not forget Edi Rama's racist operation in Theth

2025-07-10 20:18:24

The 3 zodiac signs that will be most affected by the 'Full Moon' of July 10

2025-07-10 20:04:49

New director of the National Center of Cinematography appointed

2025-07-10 19:51:12

Korça/ 40-year-old man jumps from fifth floor balcony, in critical condition

2025-07-10 19:40:19

'Tired Woman'/ The Syndrome That Affects Thousands of Women Every Day

2025-07-10 19:34:02

Jane Birkin's original Hermès bag sells for $10 million

2025-07-10 19:26:22

Britain-Ukraine agreement signed for 5,000 Thales missiles

2025-07-10 19:00:25

Fire in Zvërnec, flames endanger two hotels

2025-07-10 18:57:19

Croatia restores compulsory military service

2025-07-10 18:39:01

Spahia: The great truth of the strong accusation of the residents of Theth

2025-07-10 18:35:07

The Supreme Court left him in prison, Meta addresses the 'Constitution'

2025-07-10 17:57:21

New punishment with 'new' regulations

2025-07-10 17:54:46

EU translator fired over fears for Zelenskyy's safety

2025-07-10 17:45:37

'You are a policeman, but not God, take my soul', protest for Agon Zejnullahu

2025-07-10 17:41:21

Video/ Rama repeats the scenario, kneels before Meloni again

2025-07-10 16:56:31

He set fire to a plot of olive trees, 50-year-old man arrested in Shijak

2025-07-10 16:46:19

Rubio: US and Russia have exchanged new ideas for Ukraine peace talks

2025-07-10 16:36:20

Death of 27-year-old, Lipjan Police Commander Resigns

2025-07-10 16:21:28

Video/ An apartment burns in Tirana near the New Bazaar

2025-07-10 16:09:36

Jensila lights up the internet with her birthday greetings to Ledri

2025-07-10 15:42:08

They're full of pesticides! List of 12 products we need to be careful of

2025-07-10 15:31:04

Worker falls from scaffolding in Shëngjin, urgently sent to Trauma

2025-07-10 15:11:03

Malltezi: Within one day they seized my accounts, properties and shares

2025-07-10 15:01:23

EU: Israel has agreed to more aid to Gaza

2025-07-10 14:55:19

Murder of Reni Dobra, 23-year-old's vehicle pulled from the water

2025-07-10 14:29:23

Trump's tariffs on Brazil raise coffee prices

2025-07-10 14:16:07

Ursula von der Leyen survives no-confidence vote

2025-07-10 14:04:27

Fire in Lezha, flames near electrical substation

2025-07-10 13:32:24

Residents clash with police in Theth, a woman faints

2025-07-10 13:24:38

"Rama and Xanun"

2025-07-10 13:15:46

Zodiac signs most likely to get divorced in July 2025

2025-07-10 12:45:51

A scapegoat for an illegitimate Republic

2025-07-10 12:35:02

"He has devastated his own nation"/ Berisha: Rama imprisons his opponents!

2025-07-10 12:26:54

Albanian man injured with knife in Italy

2025-07-10 12:08:55

23-year-old in Mat drowned with rope, 4 suspects are being held

2025-07-10 10:58:53

After the dismissals, the new director of the Shkodra Police is appointed

2025-07-10 10:30:10

BIRN: Rama's action for public spaces, a repeated spectacle

2025-07-10 10:29:11

Action in Theth, Shkodra Police leaders dismissed

2025-07-10 10:16:28

Fatal accident on the Tirana-Durres highway

2025-07-10 10:01:58

The incinerator does not exist, but the government continues to increase funds

2025-07-10 09:51:45

Albania is aging at a rapid pace! 30% of the population is over 60 years old

2025-07-10 09:46:23

End of an era, Modric says 'goodbye' to Real Madrid

2025-07-10 09:36:09

Mount Dukat has been on fire for 6 days, residents request air intervention

2025-07-10 09:27:24

"Poverty on the rise"/ DW: Many people in Germany are not getting paid

2025-07-10 09:08:06

Horoscope, what do the stars have in store for you today?

2025-07-10 08:51:59

The scorching heat returns, the thermometer climbs to 40°C

2025-07-10 07:58:52

Morning Post/ In 2 lines: What mattered yesterday in Albania

2025-07-10 07:46:35

Tourist operator in Theth: They are demolishing our houses without warning

2025-07-09 22:54:57

Trump and Israeli commander warn: Gaza ceasefire could be near

2025-07-09 22:13:21

Fire in Elbasan Landfill, pedagogue: It is a cancer and environmental crime

2025-07-09 21:54:47

Dangerous summer, number of snake bites increases

2025-07-09 21:22:13

Berisha appeals again: Stop state terror against the residents of Theth!

2025-07-09 21:15:36

'Kissing disease' virus linked to several forms of cancer

2025-07-09 21:04:44

Malltezi confesses after release: Justice has become a political weapon

2025-07-09 20:51:48

Vokshi: Albania's EU integration has stalled due to lack of free elections

2025-07-09 20:37:21