Flash News

Flash News

Hell in the Gjadri camp, 45 attempted injuries and violent protests

Albanian man who dived into river to save his two deceased children from drowning gets tattooed on their faces

Why World War III is 'speaking', and the Albanian PM Rama is silent

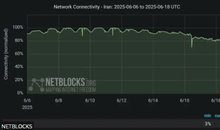

Iran faces near-total internet blackout

Accident on the Grand Ring Road, two cars collide

The Bank of Albania sets a ceiling for home loans, 85% for the first home, 80% for the second

The Supervisory Council of the Bank of Albania decided at its meeting on Wednesday several restrictive measures for bank loans for homes.

More specifically, the decision provides for the determination of ceiling levels for the indicators "Loan-to-value ratio" and "Debt service-to-income ratio", for loans granted by banks for residential real estate.

The loan-to-value ratio is the percentage of the purchase price of the home that the bank undertakes to finance through the loan.

The loan-to-value ceiling in Lek will be 85% for the first home and 80% for the second home, while in foreign currency 75% for the first home and 70% for the second home.

While the debt service to income ratio represents the ratio between the installment or installments of the property loan, in relation to the income of the borrowers.

Banking sector, is there a risk of euphoria?

The debt service to income ratio for loans in Lek will be at the level of 40% for the first home and 35% for the second home. In foreign currency, the ceiling level will be 35% for the first home and 30% for the second home.

According to the Bank of Albania, the implementation of these limits will enable the reduction of the risk of borrower failure and the reduction of banking losses related to these loans, as a result of unfavorable developments in real estate prices and in the country's macroeconomic framework, such as increased unemployment, falling incomes, increased interest rates, etc.

The Bank of Albania argues that these limits take into account and are adjusted to address risk proportionally, depending on the type of property and the currency in which the loan is granted.

At the same time, the decision provides a recommendation regarding the maximum maturity of residential real estate loans, which may serve banks to improve the risk profile of a given exposure.

The imposition of austerity measures on home loans also came as a result of recommendations from the International Monetary Fund (IMF). In an interview with "Monitor" in December 2024, the IMF suggested that the Central Bank set certain maximum levels for the ratio between the loan and the value of the property being financed, as well as for the ratio of debt service to borrowers' income (DTI).

In fact, the Bank of Albania had already expressed its concern about the rapid growth of housing loans last year. Initially, these concerns were attempted to be addressed through the introduction of a countercyclical capital surcharge, first introduced in June at 0.25% (to be implemented from 30 June 2025) and increased in December to 0.5% (to be implemented from 31 December 2025).

However, due to the high actual capitalization levels of the banking sector, such a measure has not yet had a significant impact on slowing lending. For this reason, the Bank of Albania has decided to follow the IMF recommendation and impose direct restrictions on risk management standards related to housing loans.

Bank of Albania data showed that last year new housing loans reached a new historical record of 54.9 billion lek or about 545 million euros, calculated at the average exchange rate of 2024. New housing loans increased by 13% compared to 2023.

The value of the active portfolio or outstanding home loan at the end of 2024 reached almost 208.7 billion lek, with an annual growth of 15.5%./ Monitor

Latest news

Zhulali: EU does not tolerate basic standards, membership is a political process

2025-06-18 22:40:09

Recount process/Këlliçi: DP seeks 14th mandate in Tirana

2025-06-18 22:11:20

Hell in the Gjadri camp, 45 attempted injuries and violent protests

2025-06-18 21:49:49

Israel strikes National Police headquarters in Iran, several injured reported

2025-06-18 21:29:11

Why World War III is 'speaking', and the Albanian PM Rama is silent

2025-06-18 20:08:03

Avoid drying towels in the sun, here's how to keep them soft

2025-06-18 20:07:53

Cannabis legalization in Albania, new law, old risks

2025-06-18 19:39:54

Pope Leo XIV calls for peace: Advanced weapons are temptations we must reject

2025-06-18 19:22:29

Iran faces near-total internet blackout

2025-06-18 19:07:09

INSTAT: Heart diseases, the leading cause of death in Albania during 2024

2025-06-18 18:05:33

Trump does not rule out the possibility of striking Iran

2025-06-18 17:19:35

Accident on the Grand Ring Road, two cars collide

2025-06-18 17:05:57

Kume: Vote recount increases credibility

2025-06-18 16:59:38

Ndërron jetë ish-futbollisti dhe trajneri i njohur shqiptar

2025-06-18 16:17:02

EU calls for "comprehensive reforms" for the media in Albania

2025-06-18 16:06:20

Macron convenes France's Defense and Security Council

2025-06-18 16:04:29

Israeli attacks in the last 24 hours, at least 140 killed in Gaza

2025-06-18 15:58:13

Reflection on Rama's kneeling before Meloni

2025-06-18 15:52:53

Conference League second round draw, Albanian teams learn potential opponents

2025-06-18 15:29:29

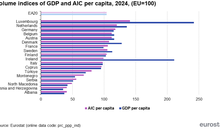

Eurostat 2024: Prices in Albania are catching up with EU levels

2025-06-18 15:07:03

War/ Why is Russia hesitant to help Iran in its conflict with Israel?

2025-06-18 15:00:19

Blushi: Ilir Meta's voice will resound louder than ever in the new Parliament

2025-06-18 14:50:42

The Electoral College also rejects the DP's complaint for Kukës and Gjirokastra

2025-06-18 14:09:49

The College rejects the DP's request for invalidation of the elections in Lezha

2025-06-18 13:41:57

Evacuation of 5 Albanians from Israel, 3 of them arrive in Albania

2025-06-18 13:23:34

Amidst chaos and abuse, is Albania ready to offer sustainable tourism?

2025-06-18 13:01:56

SMILE.al - 5 years of history, the best version of success!

2025-06-18 12:42:25

Causes of death in Albania, heart disease leads, suicides increase

2025-06-18 11:47:36

The claim for Jorgo Goro is postponed

2025-06-18 10:59:17

Gave candy and attempted to abuse minor, 60-year-old arrested in Maliq

2025-06-18 10:33:10

Israel, Iran, us and our world

2025-06-18 10:21:43

Vote recount for Tirana, Ilir Alimehmeti also present in the process

2025-06-18 10:13:14

Why is Russia hesitant to help Iran in its conflict with Israel?

2025-06-18 10:00:55

Israel-Iran War/ US Embassy in Jerusalem Temporarily Closed

2025-06-18 09:42:06

"I wanted to become a writer", Berisha recounts his dream left half-abandoned

2025-06-18 09:33:52

Author of several thefts, thief from Tirana caught in Durrës (NAME)

2025-06-18 09:24:20

Taksa të larta dhe diskrimin, pse emigrantët po largohen përsëri nga Gjermania?

2025-06-18 09:02:32

Socially dangerous person, 27-year-old arrested in Pogradec

2025-06-18 08:51:39

The recount of votes for the Tirana district begins today

2025-06-18 08:37:37

Horoscope, what do the stars have in store for you today?

2025-06-18 08:12:05

Morning Post/ In 2 lines: What mattered yesterday in Albania

2025-06-18 07:45:20

Former prosecutor: Criminal groups are more structured in Albania

2025-06-17 22:02:21

Korça/ A woman comes into contact with electricity

2025-06-17 20:55:40

Death makes you neither good nor bad.

2025-06-17 20:38:05

Only 1 in 5 tourists sleep in apartments or hotels

2025-06-17 20:25:16

European Commission proposes complete ban on Russian gas imports

2025-06-17 19:46:58

'Serious concern': EU condemns government attacks on SPAK after Veliaj's arrest

2025-06-17 19:36:01

Fuel prices soar amid Israel-Iran tensions

2025-06-17 19:19:12

Iranian military says it struck Israeli military intelligence center in Tel Aviv

2025-06-17 18:17:27

The recount of 94 boxes of Gramsh and Peqin is completed

2025-06-17 18:08:47

Source: The world order is destroyed, how is the world being run today

2025-06-17 17:50:28