Flash News

Flash News

9 months after taking office, the Chief of the Guard, Ermal Onuzi, resigns

He breaks arrest, steals a car and escapes like in a movie, the serial thief from Tirana is caught!

Name/ She deceived clients and took their money, the lawyer is wanted

Criminal group busted, trafficking dogs from Spain to Finland, the 'heads' of the group were Albanians

She escaped drowning in Durres, the 31-year-old English woman speaks: We capsized instantly, my friend was trapped under the vehicle

Coefficients, how calculations are made for newly retired people

For newly retired persons, the Social Security Institute will apply the new salaries for the purpose of calculating pensions.

The update of salaries before '94 will be done with the coefficient of 13.5 percent, unlike a year ago, thus reflecting the level of salaries for 83 professions. For the last two years, i.e. for 2023 and 2024, the indexation formula is not applied, but salaries are referred to as they are, i.e. unindexed. The decision is taken by the Administrative Council at the Social Security Institute every year in July.

Every year, approximately 20,000 citizens who retire benefit from salary updates in order to increase the amount of benefits. The coefficient is expected to increase the estimated base for over 20,000 people, enabling their pensions to be harmonized with the contributions paid.

WHO BENEFITS

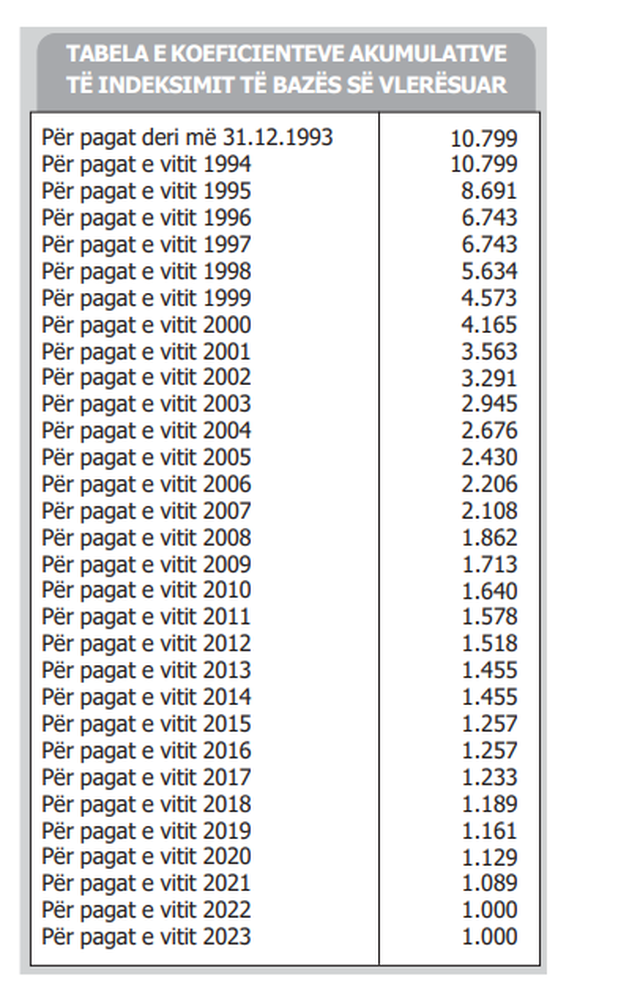

As every year, in addition to the indexation of pensions, the government also drafts new coefficients, on the basis of which the pension amount is calculated for those who are just retiring and not for all pensioners. This automatically brings a change in the formula for calculating the value that the elderly benefit from. Thus, based on the table with the new coefficients (according to the table next to the article) a person who in 1994 was treated with a salary of 7 thousand lek, this amount will be multiplied by the coefficient 10,799 and for calculating the pension, the salary of 75 thousand and 593 lek will be taken into account.

Usually, the salary with which contributions have been paid over the years is taken into account when determining the pension amount, but because salaries during the time of the former agricultural cooperatives, but also in the following years, have been low, the government sets new coefficients every year to obtain a pension that is as realistic as possible for the period that pensioners live.

FORMULA

The formula used to calculate the pension is: PP (Old Age Pension) = PS (Social Pension)* (multiplied) actual contributory seniority/required contributory seniority + 1/100* (multiplied) years of insurance* BV (estimated base).

The estimated base for calculating pensions is calculated as the ratio of the amount of wages, for which contributions have been paid, to the period known as the insurance period. For the insurance period from 1.1.1994 onwards, for calculating the estimated base, the amount of wages, for which contributions have been paid from 1.1.1994 until the end of the insurance period is taken. For the insurance period in state institutions and enterprises before 1.1.1994, for calculating the estimated base, the reference wages, determined by decision of the Council of Ministers, are taken. For the insurance period in former agricultural cooperatives, for calculating the estimated base, the reference wages determined by decision of the Council of Ministers are taken.

In cases where the insured person has an insurance period before and after 1.1.1994, the estimated base is calculated as the weighted arithmetic average of the estimated base of the insurance periods, as a former employee of state institutions or enterprises and former member of agricultural cooperatives before 1994, as well as of the insurance periods as an employed, self-employed or economically active person after 01.01.1994./Gazeta Panorama

Latest news

Baçi: Rama was afraid of popular discontent, stole more votes than he thought

2025-06-03 22:10:14

9 months after taking office, the Chief of the Guard, Ermal Onuzi, resigns

2025-06-03 20:14:09

15-year-old injured by gunfire at 'Ali Demi' pizzeria, police arrest perpetrator

2025-06-03 19:32:04

Why don't I want to spend a single day in Vlora?!

2025-06-03 18:26:21

Tech-stinction alert: Will humanity shrink to just 100 million people?

2025-06-03 18:02:23

EPP accepts Berisha's request: A fact-finding mission will be sent to Albania

2025-06-03 17:49:47

Three vehicles collide in Elbasan, several injured suspected

2025-06-03 17:45:02

Prosecutor Marsida Frashëri faces a request for dismissal at the KPA

2025-06-03 17:21:57

Nga Holanda në Finlandë, si operonte rrjeti shqiptar i drogës

2025-06-03 17:10:34

Tusk kërkon votëbesim në parlamentin polak më 11 qershor

2025-06-03 16:59:01

EUROPOL: Minors increasingly targeted by terrorist propaganda

2025-06-03 15:04:56

Kindergarten in Gramsh reopens where children were poisoned with salmonella

2025-06-03 14:59:16

OECD: Global economy heading for weakest growth since Covid-19

2025-06-03 14:35:26

A farm in Postribë, Shkodra, is quarantined, small livestock infected,

2025-06-03 14:21:50

74-year-old from Kamza, the oldest high school graduate in the English exam

2025-06-03 13:59:30

The average salary in Kosovo reached 639 euros in 2024

2025-06-03 13:49:00

Osmani invites parties to consult on the date of local elections

2025-06-03 13:41:33

Name/ She deceived clients and took their money, the lawyer is wanted

2025-06-03 13:25:24

He hit and killed a 59-year-old man and fled, the young man is wanted

2025-06-03 12:58:29

Two cars collide in Bulqiza, drivers injured

2025-06-03 12:34:46

15 people arrested for cyber fraud and misuse of bank cards in Gjilan

2025-06-03 12:02:41

Greece and Turkey hit by earthquake

2025-06-03 11:49:08

Due to lack of lawyers/ The hearing for the 'Golden Bullet' is postponed again

2025-06-03 11:36:52

More than half of foreigners in Serbia are Russians

2025-06-03 11:15:59

Scandal repeats, English exam thesis leaked

2025-06-03 10:46:54

They printed fake logos of well-known brands, 4 arrested, two others wanted

2025-06-03 09:42:58

A verbal agreement by Rama prompted the contested interventions in Spaç

2025-06-03 09:23:32

Horoscope, what do the stars have in store for you today?

2025-06-03 08:34:30

Temperatures up to 31 degrees Celsius, weather forecast for this Tuesday

2025-06-03 08:09:06

Morning Post/ In 2 lines: What mattered yesterday in Albania

2025-06-03 07:51:10

Convinced DP candidate: Tirana district is opening, MPs' order changes

2025-06-02 21:42:53

Cara: At the head of the state is a party that was not voted for by Albanians

2025-06-02 21:16:53

The constitution of the Kosovo Assembly fails for the 25th time

2025-06-02 21:10:46

"130 thousand unused ballots", CEC responds to the DP

2025-06-02 20:51:02

Italian professor who insulted Giorgia Meloni's daughter attempts suicide

2025-06-02 20:25:21

Fire breaks out in a building in Astir

2025-06-02 20:22:46

Two women threaten the Saranda prosecutor in her office

2025-06-02 19:09:20

Etna wakes up again, the most active volcano in Europe erupts

2025-06-02 19:00:36

Fire reactivates in Darëzeza forest, firefighting efforts impossible

2025-06-02 17:28:29

Cultivating cannabis on a plot, 35-year-old arrested in Mirdita

2025-06-02 16:59:27

Switzerland/ Albanian caught with drugs worth over 1 million euros

2025-06-02 16:50:38

Kosovo-Serbia dialogue meetings resume in Brussels

2025-06-02 16:32:44

The VPN Era in Albania: How the TikTok Ban is "Failing", Video Views Increase

2025-06-02 16:26:36

Mahmut Orhan brings a unique experience with Curious X

2025-06-02 16:19:55

Businesses "forgot" to pay for elections, liabilities reached 4.7 billion lek

2025-06-02 15:50:27

Photo/ Caught with cocaine, Albanian arrested in Britain

2025-06-02 15:31:12

He violently opposed police officers, 39-year-old arrested in Vlora

2025-06-02 15:04:28