Flash News

Flash News

Hell in the Gjadri camp, 45 attempted injuries and violent protests

Albanian man who dived into river to save his two deceased children from drowning gets tattooed on their faces

Why World War III is 'speaking', and the Albanian PM Rama is silent

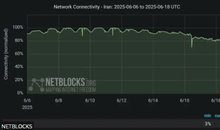

Iran faces near-total internet blackout

Accident on the Grand Ring Road, two cars collide

Lek loans are tightened, interest rates reach the highest level since 2018

The increase in interest rates in the financial market is beginning to be reflected in the price of new loans in Lek. Bank of Albania data show that in September, the average interest rate for new loans in Lek reached 7.07%, the highest level since February 2018.

Currently, the average interest rate of new loans in ALL has increased by 1.18 percentage points compared to a year ago and by 1.6 percentage points compared to March of this year, when the Bank of Albania started monetary normalization. The growth has started to take on stable characteristics, especially after the month of July, and the average interest of new loans is increasing already for the third month in a row.

Meanwhile, for existing borrowers who have loans with variable interest, the increase in rates is transmitted automatically, through the benchmark indicator, which in the case of the lek is usually the average yield of treasury bonds. From March onwards, yields have been rising at a rapid pace. The most used benchmark instrument, 12-month bonds, in October were issued with a weighted average yield of 5.26%, increasing by 3.56 percentage points compared to the same period a year ago. The increase in yields is automatically transmitted to borrowers, in the reassessment of the loan interest rate, which is carried out at least once a year. But now, the banking sector seems to be reflecting the increase in the basic interest rate and yields in the interest rates of new loans.

After a long period when interest rates in the financial market remained close to historical lows, the price crisis and the rapid increase in inflation have caused central banks to begin a rapid monetary normalization. The base interest rate has increased from 0.5% to 2.25% over six months. The increase in the base rate by the Bank of Albania increases the price of injecting money into the system. With the increase in the cost of their short-term financing with REPO from the Bank of Albania, the banks reacted by increasing the yields required to finance the government debt. Meanwhile, high inflation and the signals given by the Bank of Albania created strong expectations for the continuation of the increase in the base interest rate, encouraging an increase in yields even higher than that of the base rate, especially in short-term instruments.

Such a situation is creating incentives to transmit the increase in interests to deposits and bank loans as well. The rise in yields increased the pressure on deposit interest rates, because bonds and bonds are becoming a more affordable option for individuals, which may lead them to withdraw money from deposits and invest it in bonds. With the increase in the interest rate of deposits, which has already started to appear, banks are gradually increasing the interest rates of loans, in order to maintain their intermediation margins.

At the moment, the follow-up in the interest rates of new loans is slower, but the market is already giving clear signals that it has started to move in this direction.

Nga ana tjetër, rritja e fortë e yield-eve të bonove përfaqëson në vetvete një faktor shtesë që nxit rritjen e interesave për sektorin privat, për shkak të logjikës së riskut. Investimi në borxhin e qeverisë konsiderohet investimi me risk më të ulët, ndërsa çdo huamarrës privat teorikisht ka një rrezik më të lartë se qeveria. Edhe nga pikëmamja teknike, instrumentet e borxhit të qeverisë në lekë për bankat peshohen me koeficientë rreziku 0, për efekt të llogaritjes së mjaftueshmërisë së kapitalit. Kjo do të thotë se investimi në bono nuk kërkon mbulim me kapital, ndërsa dhënia e kredive për sektorin privat ka një kosto për bankat në terma të kapitalit. Rrjedhimisht, logjika e investimit dikton që rritja e yield-eve të reflektohet edhe në normat e interesit të kredive të reja për sektorin privat.

The increase in loan interest rates is expected to gradually bring about a slowdown in lending. This means less injection of money into the economy, slowing down consumption, investments and domestic demand and softening inflationary pressures, which essentially represents the goal of monetary policy in this situation./Monitor

Latest news

Zhulali: EU does not tolerate basic standards, membership is a political process

2025-06-18 22:40:09

Recount process/Këlliçi: DP seeks 14th mandate in Tirana

2025-06-18 22:11:20

Hell in the Gjadri camp, 45 attempted injuries and violent protests

2025-06-18 21:49:49

Israel strikes National Police headquarters in Iran, several injured reported

2025-06-18 21:29:11

Why World War III is 'speaking', and the Albanian PM Rama is silent

2025-06-18 20:08:03

Avoid drying towels in the sun, here's how to keep them soft

2025-06-18 20:07:53

Cannabis legalization in Albania, new law, old risks

2025-06-18 19:39:54

Pope Leo XIV calls for peace: Advanced weapons are temptations we must reject

2025-06-18 19:22:29

Iran faces near-total internet blackout

2025-06-18 19:07:09

INSTAT: Heart diseases, the leading cause of death in Albania during 2024

2025-06-18 18:05:33

Trump does not rule out the possibility of striking Iran

2025-06-18 17:19:35

Accident on the Grand Ring Road, two cars collide

2025-06-18 17:05:57

Kume: Vote recount increases credibility

2025-06-18 16:59:38

Ndërron jetë ish-futbollisti dhe trajneri i njohur shqiptar

2025-06-18 16:17:02

EU calls for "comprehensive reforms" for the media in Albania

2025-06-18 16:06:20

Macron convenes France's Defense and Security Council

2025-06-18 16:04:29

Israeli attacks in the last 24 hours, at least 140 killed in Gaza

2025-06-18 15:58:13

Reflection on Rama's kneeling before Meloni

2025-06-18 15:52:53

Conference League second round draw, Albanian teams learn potential opponents

2025-06-18 15:29:29

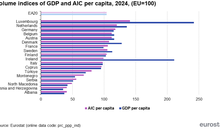

Eurostat 2024: Prices in Albania are catching up with EU levels

2025-06-18 15:07:03

War/ Why is Russia hesitant to help Iran in its conflict with Israel?

2025-06-18 15:00:19

Blushi: Ilir Meta's voice will resound louder than ever in the new Parliament

2025-06-18 14:50:42

The Electoral College also rejects the DP's complaint for Kukës and Gjirokastra

2025-06-18 14:09:49

The College rejects the DP's request for invalidation of the elections in Lezha

2025-06-18 13:41:57

Evacuation of 5 Albanians from Israel, 3 of them arrive in Albania

2025-06-18 13:23:34

Amidst chaos and abuse, is Albania ready to offer sustainable tourism?

2025-06-18 13:01:56

SMILE.al - 5 years of history, the best version of success!

2025-06-18 12:42:25

Causes of death in Albania, heart disease leads, suicides increase

2025-06-18 11:47:36

The claim for Jorgo Goro is postponed

2025-06-18 10:59:17

Gave candy and attempted to abuse minor, 60-year-old arrested in Maliq

2025-06-18 10:33:10

Israel, Iran, us and our world

2025-06-18 10:21:43

Vote recount for Tirana, Ilir Alimehmeti also present in the process

2025-06-18 10:13:14

Why is Russia hesitant to help Iran in its conflict with Israel?

2025-06-18 10:00:55

Israel-Iran War/ US Embassy in Jerusalem Temporarily Closed

2025-06-18 09:42:06

"I wanted to become a writer", Berisha recounts his dream left half-abandoned

2025-06-18 09:33:52

Author of several thefts, thief from Tirana caught in Durrës (NAME)

2025-06-18 09:24:20

Taksa të larta dhe diskrimin, pse emigrantët po largohen përsëri nga Gjermania?

2025-06-18 09:02:32

Socially dangerous person, 27-year-old arrested in Pogradec

2025-06-18 08:51:39

The recount of votes for the Tirana district begins today

2025-06-18 08:37:37

Horoscope, what do the stars have in store for you today?

2025-06-18 08:12:05

Morning Post/ In 2 lines: What mattered yesterday in Albania

2025-06-18 07:45:20

Former prosecutor: Criminal groups are more structured in Albania

2025-06-17 22:02:21

Korça/ A woman comes into contact with electricity

2025-06-17 20:55:40

Death makes you neither good nor bad.

2025-06-17 20:38:05

Only 1 in 5 tourists sleep in apartments or hotels

2025-06-17 20:25:16

European Commission proposes complete ban on Russian gas imports

2025-06-17 19:46:58

'Serious concern': EU condemns government attacks on SPAK after Veliaj's arrest

2025-06-17 19:36:01

Fuel prices soar amid Israel-Iran tensions

2025-06-17 19:19:12

Iranian military says it struck Israeli military intelligence center in Tel Aviv

2025-06-17 18:17:27

The recount of 94 boxes of Gramsh and Peqin is completed

2025-06-17 18:08:47

Source: The world order is destroyed, how is the world being run today

2025-06-17 17:50:28