Flash News

Flash News

Fire breaks out in a building in Astir

KAS rejected the request for a recount of votes, Alimehmeti sues the CEC in the Electoral College

Mahmut Orhan brings a unique experience with Curious X

Six police officers are sent to court, they did not impose fines even though they saw violations

Murder of Martin Cani/ 5 minors called to testify in Court, perpetrator denies charges

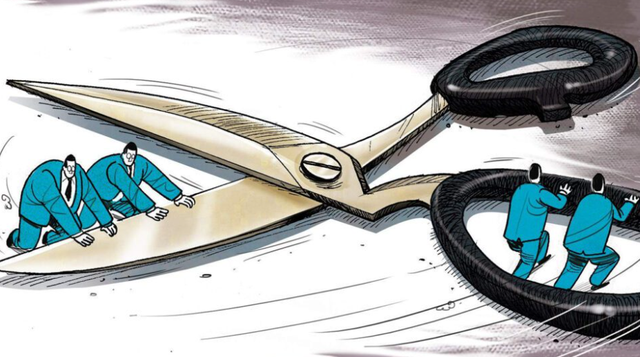

Two days before the elections, the government also approved a decision to repeal unexecuted administrative measures for the period from January 1, 2015 to November 30, 2024.

Earlier, just before the elections, the government announced the "Fiscal Peace" initiative, which envisages the cancellation of tax liabilities accumulated for more than 10 years and the partial forgiveness of 5- to 10-year liabilities.

The initiative was not unexpected, as always before election periods, the government tries to make "peace" with business.

Albania has implemented such interventions from time to time, starting in 2008, when tax and customs arrears were forgiven until December 31, 2007, or in 2014 (when fines and late payment interest were forgiven for taxpayers who made principal payments until December 31, 2014, with the aim of formalizing tax debts and administrative forgiveness).

The repeated attempts in recent years for a fiscal and administrative amnesty for the declaration of unregistered profits have failed to become a reality, due to the constant opposition of financial institutions, forcing the government to "hide" the amnesty through fiscal peace.

Even this initiative did not avoid the constant debate about the moral damage caused by these types of movements, as it stimulates tax evaders and the concealment of obligations, as well as discourages regular taxpayers who have paid their obligations.

History confirms this concern. At the end of 2024, according to official Tax data, the balance of unpaid tax liabilities amounted to 162.5 billion lek, or about 1.6 billion euros, an increase of 4.7% compared to the previous year.

But the peace seems to have vanished immediately after the elections, before they even started. In its place was "war." Businesses report that inspections by labor and health inspectorates, which had subsided in recent months, have resumed with vigor.

The Tax Administration recently gained immediate access to information on registered vehicles, which will enable real-time data monitoring for the purpose of collecting tax debts, warning of an intensification of the process of forcible collection of liabilities.

It is no secret that Albania has a high level of tax evasion. The revenues that the government collects from taxes paid by businesses and individuals have been increasing in value year after year, but in relation to the size of the economy, they have fluctuated since 1998, in the range of 26-28% of GDP.

This level is much lower than the European Union average of 40% of GDP, or than other countries in the region (with the exception of Kosovo), which fluctuate at 34-40% of GDP.

The highest informality remains in the labor market, with income from social and health insurance not exceeding 6% of GDP, half the European average.

There are many ways to combat tax evasion, but neither war nor fiscal peace, which send opposing messages to taxpayers, are among them.

Strengthening tax administration through digitalization of the invoicing and financial reporting system increases transparency and reduces scope for evasion.

Also, expanding the taxpayer base, especially in the informal sector, and providing incentives for voluntary declaration, are effective tools.

Consistent legislation, a simplified system with few tax rates, easy declaration and payment procedures, and clear rules help reduce compliance costs for businesses and individuals. This makes it easier to comply with tax obligations and reduces the incentive for evasion.

The Government must also send a strong message against tax evasion and in favor of voluntary compliance with tax obligations by clearly and transparently showing how taxes are transformed into concrete and quality public services.

This requires that tax revenues be administered with efficiency, integrity and transparency, being directed towards improving infrastructure, health, education and social protection.

The higher the waste, through inefficient concessions, corruption in tenders, and allowing evasion, the stronger the "resistance" of businesses and individuals will be.

Only when citizens see that their tax contribution translates into real improvements in their lives will this increase trust in the state and reduce the motivation for tax evasion.

For now, the signs are that the "war" will continue until the "peace" of the next elections./ Monitor

Latest news

Fire breaks out in a building in Astir

2025-06-02 20:22:46

Two women threaten the Saranda prosecutor in her office

2025-06-02 19:09:20

Etna wakes up again, the most active volcano in Europe erupts

2025-06-02 19:00:36

Fire reactivates in Darëzeza forest, firefighting efforts impossible

2025-06-02 17:28:29

Cultivating cannabis on a plot, 35-year-old arrested in Mirdita

2025-06-02 16:59:27

Switzerland/ Albanian caught with drugs worth over 1 million euros

2025-06-02 16:50:38

Kosovo-Serbia dialogue meetings resume in Brussels

2025-06-02 16:32:44

The VPN Era in Albania: How the TikTok Ban is "Failing", Video Views Increase

2025-06-02 16:26:36

Mahmut Orhan brings a unique experience with Curious X

2025-06-02 16:19:55

Businesses "forgot" to pay for elections, liabilities reached 4.7 billion lek

2025-06-02 15:50:27

Photo/ Caught with cocaine, Albanian arrested in Britain

2025-06-02 15:31:12

He violently opposed police officers, 39-year-old arrested in Vlora

2025-06-02 15:04:28

DP demands Rusmal's expulsion from KAS, Logu: It is biased, Begaj's advisor

2025-06-02 14:37:24

Anemia is increasing in the population

2025-06-02 14:32:18

Fires in Darëzezë reactivate, wind spreads flames

2025-06-02 13:57:33

Traffic jams and over 14 thousand fines, Traffic Police take stock of the week

2025-06-02 13:40:51

Eurosceptic Nawrocki wins presidential election in Poland

2025-06-02 13:33:27

Hysaj: Against Serbia with calm and courage, this match is for national pride

2025-06-02 13:14:41

Bulgaria defies chaos and continues on path to euro

2025-06-02 12:53:28

Elected MP, Tedi Blushi resigns from Tirana Municipal Council

2025-06-02 12:29:36

Murder in Tale, the author of the execution of Pjetër Kazaj is identified

2025-06-02 12:07:27

'Justice for Hamid': Activists protest against Gjadri camp

2025-06-02 11:41:26

The draw is made, judge Elsa Ulliri will judge the "Partizani" case

2025-06-02 11:26:52

The 25th attempt to constitute the Kosovo Assembly also fails

2025-06-02 11:12:29

Coefficients, how calculations are made for newly retired people

2025-06-02 10:11:17

Two vehicles burned in Maliq, arson suspected

2025-06-02 10:00:03

Logu: They deny us transparency about the May 11th farce!

2025-06-02 09:44:46

Ten ways to feel energized if even coffee doesn't work for you

2025-06-02 09:33:49

I shpallur në kërkim për llogari të Kosovës, arrestohet i riu nga Tepelena

2025-06-02 09:24:39

African heat wave begins in Albania, meteorology warns of dry summer

2025-06-02 09:11:48

Foreign exchange, how much foreign currencies are sold and bought today

2025-06-02 09:02:45

Truck catches fire on 'Rruga e Kombit', driver escapes

2025-06-02 08:56:21

On the May 11 electoral farce in Albania

2025-06-02 08:47:54

Priest Kristaq Vaso dies after falling from church roof in Korça

2025-06-02 08:32:29

Horoscope, what do the stars have in store for you today?

2025-06-02 08:10:47

Stable weather across the country, weather forecast

2025-06-02 07:59:25

Morning Post/ In 2 lines: What mattered yesterday in Albania

2025-06-02 07:46:43

Official, Juventus appoints Damien Comolli as general director

2025-06-01 21:57:45

"Russia could attack NATO in the next 4 years," warns German defense chief

2025-06-01 21:34:42

Kuçana: Opposition candidates have been threatened by "Rama's gangs in Shkozet"

2025-06-01 21:11:15

15-year-old injured in shooting at Ali Demi's pizzeria, details from police

2025-06-01 19:51:19

Russia accuses Ukraine of 'terrorist attack' on air bases

2025-06-01 18:57:24

A hospital in Hamburg, Germany, catches fire, killing three patients

2025-06-01 18:32:28

Nesho: Rama's autocratic regime has not allowed free elections to take place

2025-06-01 18:10:23

Moroccan immigrant's suicide, activist: There are inhumane conditions in Gjadra

2025-06-01 17:49:32

World Bank Report, PL: Confirms that the majority of Albanians live in poverty

2025-06-01 17:23:56

31 dead after Israeli attack near Gaza aid center

2025-06-01 16:40:30

At least 150 dead in Nigeria floods

2025-06-01 16:14:26

Flames engulf the Darëzeza forest massif in Fier

2025-06-01 15:56:41

SHBA-ja i dërgon Iranit një propozim për marrëveshje bërthamore

2025-06-01 14:54:11

Moroccan immigrant commits suicide, activists protest in front of Gjadri camp

2025-06-01 13:48:17

PSG victory celebrations turn into tragedy, two dead, over 500 arrested

2025-06-01 13:26:33

Kosovo-Albania arms trafficking, Tirana Court leaves 8 arrested in prison

2025-06-01 12:41:11

Foreign worker dies at work, engineer of construction firm arrested in Tirana

2025-06-01 12:20:27

Car hits motorbike, 25-year-old dies in Bilisht

2025-06-01 11:56:56