Flash News

Flash News

Lavrov: NATO is risking self-destruction with new military budget

Kurti and Vučić "face off" tomorrow in Skopje

Construction worker dies after falling from scaffolding in Berat

The prosecution sends two Korça Municipality officials to trial

Violation with the €2.3 million tender, GJKKO imposes security measures on the head of the Public Procurement Commission, he is suspended from duty

Cargo ships and container ships are facing long waits at major port hubs, with problems expected to last for months. Donald Trump's volatile tariff policies, combined with low river levels, are causing the biggest disruptions to Europe's supply chains since the coronavirus pandemic, shipping and logistics companies are warning.

Flatbed cargo ships (barges) have been left waiting for days to haul in goods, and container ships are facing long delays, with the problems, most pronounced in the ports of Rotterdam, Antwerp and Hamburg, expected to last for at least several months.

“All the major port hubs are at capacity,” said Caesar Luikenaar, managing director of Dutch shipping company WEC Lines. He said a number of major ports across Europe are operating at full capacity.

Albert van Ommen, CEO of Dutch logistics company Euro-Rijn Group, said he considered this congestion to be the most severe since the pandemic, when cargo flows remained surprisingly high and exceeded the capacity of ports facing labor shortages.

These problems constitute the latest blow to a global logistics system that until recently allowed many companies to maintain minimal inventory, confident in the fact that scheduled transportation services would regularly refresh supplies, according to a predetermined calendar.

German logistics company Contargo has warned its customers that ships are waiting an average of 66 hours to load containers in Antwerp and 77 hours in Rotterdam. These ships need certain time slots to load at container terminals to ensure efficient unloading and transport of goods.

Casper Ellerbaek, a senior executive at DHL Germany, said the delays had not yet forced any of his customers to halt production due to a shortage of components, but he added that such a "drama" remained a potential risk.

Van Ommen said that in Antwerp, the second busiest container port in Europe, ships were unloading three to five days late.

Logistics companies blamed the crisis on factors such as sudden changes in US tariff policies under President Donald Trump, which have forced container shipping lines to reorganize their networks to adapt to significantly changed global trade flows.

The problems have been further exacerbated by restrictions on ship loading on the Rhine River, after spring droughts left water at extremely low levels.

At the same time, terminals are facing major reorganizations in shipping line alliances, as Switzerland's Mediterranean Shipping Company and Denmark's Maersk, the two largest container shipping lines, have ended their previous cooperation agreement. The changes could bring short-term disruptions as lines change schedules or switch to other terminals.

Meanwhile, European ports are also facing rising import volumes from Asia as high US tariffs are causing goods to be diverted elsewhere. DHL's Ellerbaek blamed the sharp increase in container volumes from Asia to Europe, which he estimated at around 7 percent a year, on changes in the strategies of Asian exporters.

Industry representatives said terminal operators, mostly private companies that rent space at ports from public port authorities, are rushing to hire new staff and buy new equipment to ease the pressure.

ECT, one of the main terminal operators in Rotterdam, acknowledged that the facility was “quite busy” but insisted that this phenomenon was common in northern European ports. ECT cited changes in alliances, growing demand and “geopolitical and economic uncertainties” as reasons.

Mark Rosenberg, commercial director for ports and terminals at Dubai-based DP World, which owns terminals in locations including Antwerp and Rotterdam, said his company's teams were "working diligently" to manage cargo flow and "mitigate disruptions wherever possible."

The Antwerp-Bruges Port Authority, the public institution that manages the port, acknowledged that there is “increased and prolonged congestion.” “This brings short-term operational difficulties, but our systems continue to function within planned limits.” However, some voices in the industry expressed pessimism that the congestion can be easily resolved.

Luikenaar said some shipping companies serving the local market in Europe were being forced to spend a week, instead of the normal maximum of three days, collecting containers from various terminals in Rotterdam for distribution to ports in the region. He said it would take years for investment in sufficient capacity to solve all these problems./FT

Latest news

Fuga: Journalism in Albania today in severe crisis

2025-06-30 21:07:11

"There is no room for panic"/ Moore: Serbia does not dare to attack Kosovo!

2025-06-30 20:49:53

Temperatures above 40 degrees, France closes nuclear plants and schools

2025-06-30 20:28:42

Lavrov: NATO is risking self-destruction with new military budget

2025-06-30 20:13:54

Turkey against the "Bektashi state" in Albania: Give up this idea!

2025-06-30 20:03:24

Accused of sexual abuse, producer Diddy awaits court decision

2025-06-30 19:40:44

Kurti and Vučić "face off" tomorrow in Skopje

2025-06-30 18:44:12

Tourism: new season, old problems

2025-06-30 18:27:23

Construction worker dies after falling from scaffolding in Berat

2025-06-30 17:51:44

Almost free housing: East Germany against depopulation

2025-06-30 16:43:06

Hamas says nearly 60 people killed in Gaza as Trump calls for ceasefire

2025-06-30 16:14:15

Drownings on beaches/ Expert Softa: Negligence and incompetence by institutions!

2025-06-30 16:00:03

European ports are overloaded due to Trump tariffs

2025-06-30 15:30:44

The prosecution sends two Korça Municipality officials to trial

2025-06-30 15:19:54

Lezha/ Police impose 3165 administrative measures, handcuff 19 drivers

2025-06-30 14:55:04

Young people leave Albania in search of a more sustainable future

2025-06-30 14:47:52

Record-breaking summer, health threats and preventive measures

2025-06-30 14:36:19

Constitution of the Parliament, Osmani invites political leaders to a meeting

2025-06-30 14:07:54

Heat wave 'invades' Europe, Spain records temperatures up to 46 degrees Celsius

2025-06-30 13:42:02

Accident in Vlora, car hits 2 tourists

2025-06-30 13:32:16

Kurti confirms participation in today's official dinner in Skopje

2025-06-30 13:03:27

Fight between 4 minors in Kosovo, one of them injured with a knife

2025-06-30 12:38:45

Report: Teenage girls the loneliest in the world

2025-06-30 12:20:40

Commissioner Kos and Balkan leaders meet in Skopje on Growth Plan

2025-06-30 12:07:59

Wanted by Italy, member of a criminal organization captured in Fier

2025-06-30 11:55:53

Hundreds of families displaced by wave of Israeli airstrikes in Gaza

2025-06-30 11:45:17

Zenel Beshi: The criminal who even 50 convictions won't move from Britain

2025-06-30 11:23:19

A new variant of Covid will circulate during the summer, here are the symptoms

2025-06-30 11:14:58

"Partizani" case, trial postponed to July 21 at the Special Court

2025-06-30 10:41:05

Uncontrolled desire to steal, what is kleptomania, why is it caused

2025-06-30 10:30:08

Requested change of security measure, hearing for Malltez postponed to July 7

2025-06-30 10:24:32

Output per working hour in Albania 35% lower than the regional average

2025-06-30 09:54:35

The trial for the "Partizani" file begins today

2025-06-30 09:27:57

22 fires in the last 24 hours in the country, 2 still active

2025-06-30 09:21:28

How is the media controlled? The 'Rama' case and government propaganda

2025-06-30 09:13:36

German top diplomat: Putin wants Ukraine to capitulate

2025-06-30 09:00:07

Foreign exchange, how much foreign currencies are sold and bought today

2025-06-30 08:44:38

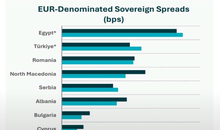

Chart/ Sovereign risk for Albania from international markets drops significantly

2025-06-30 08:26:38

Horoscope, what do the stars have in store for you?

2025-06-30 08:11:44

Clear weather and passing clouds, here is the forecast for this Monday

2025-06-30 07:59:32

Morning Post/ In 2 lines: What mattered yesterday in Albania

2025-06-30 07:47:37

Milan make official two departures in attack

2025-06-29 21:57:23

6 record tone

2025-06-29 21:30:46

4-year-old girl falls from balcony in Lezha, urgently taken to Trauma

2025-06-29 21:09:58

Assets worth 12 million euros seized from cocaine trafficking organization

2025-06-29 19:39:43

Fire in Durrës, Blushi: The state exists only on paper

2025-06-29 19:17:48

Fire endangers homes in Vlora, helicopter intervention begins

2025-06-29 18:27:51

France implements smoking ban on beaches and parks

2025-06-29 18:02:08

England U-21 beat Germany to become European champions

2025-06-29 17:42:49

Trump criticizes Israeli prosecutors over Netanyahu's corruption trial

2025-06-29 17:08:10

Street market in Durrës engulfed in flames

2025-06-29 16:52:57

UN nuclear chief: Iran could resume uranium enrichment within months

2025-06-29 16:03:24

Albanian man dies after falling from cliff while climbing mountain in Italy

2025-06-29 15:52:01

Another accident with a single-track vehicle in Tirana, a car hits a 17-year-old

2025-06-29 15:07:15

While bathing in the sea, a vacationer in Durrës dies

2025-06-29 14:54:01

Sentenced to life imprisonment, cell phone found in Laert Haxhiu's cell

2025-06-29 14:26:40

77 people detained in protest, Vučić warns of new arrests

2025-06-29 14:07:46

From a hospital for children to a prison for politicians

2025-06-29 13:34:02

77-year-old man found dead in Pogradec

2025-06-29 13:13:10

The Metropolitan of Gjirokastra passes away

2025-06-29 12:52:27

The 39th session to elect the speaker of Kosovo's parliament also fails

2025-06-29 12:31:28

France bans smoking on beaches and parks

2025-06-29 12:16:23

Alarm from the Philippines: Albania, a growing destination for labor trafficking

2025-06-29 11:50:34