Flash News

Flash News

Accused of murder due to blood feud, 48-year-old arrested in England

SPAK conducts searches at Ergys Agas' businesses and residences, seizes two vehicles

Members of criminal organizations! 3 Albanians extradited from Dubai today

Berisha warns of new facts about the electoral farce: Don't forget that the laptop hasn't started talking yet

Berisha to gather political leaders tomorrow

"Fiscal Peace" without consultation with the EU, Brussels concerned

At the height of the electoral campaign, Prime Minister Edi Rama suddenly proposed to businesses the "Fiscal Peace" plan, which he described as "inspired by the principles of Ancient Rome."

"We have thought of a plan (…) used time and time again in different forms, a fiscal peace plan," Rama declared.

But while the initiative was presented as a step towards calming relations between the state and business, it was not received with the same enthusiasm in Brussels. In an official response to Faktoje.al, the European Commission confirms that it was not asked about this proposal.

"The Commission is aware of the 'Fiscal Peace' proposal, made in the context of the electoral campaign. We have not been consulted by the Albanian authorities on this proposal," a European Commission spokesperson told Faktoje.al, adding how the initiative could affect Albania's accession process.

"Within the framework of the EU accession process, this initiative will be discussed as part of the negotiations on the relevant chapters of the EU acquis," he concludes.

While in Albania there is talk of debt forgiveness, tax reviews and "clarity for businesses", in Brussels questions are being raised about the way this initiative was announced: without transparency, without consultation and at a delicate political moment.

What does 'Fiscal Peace' entail?

According to the government, "Fiscal Peace" is a relief package that includes massive debt forgiveness and a review of tax obligations. The package is not part of the political program "Albania 2030", but the government argues that it will bring less stress to businesses, fewer controls and more clarity.

The three main pillars of Fiscal Peace:

Agreed Tax on Profit

Review of Financial Statements

Forgiveness of Liabilities and Interest on Late Payments

The initiative provides for the full cancellation of tax debts older than 10 years, if they are still outstanding. For liabilities from 5-10 years, a 50% cancellation of the debt is foreseen, if the business pays it immediately. While businesses that do not have the possibility of immediate repayment, there will be a 12-month agreement and the forgiveness will be at the rate of 25%. Social security liabilities are not included here.

The package also proposes the revision of previous income tax returns.

Businesses are given the right to revise their tax returns for the last 5 years without penalties or interest (current legislation allows for 3 years) but by paying a 5% profit tax for any profit difference created by the revision.

Albanian businesses owe the state 162.5 billion lek, or 1.6 billion euros, in unpaid taxes and customs duties. Value-added tax (VAT) and profit tax are the main taxes that businesses have not paid over the years. Official data shows that 84.7% of the debt is overdue for more than 2 years. Meanwhile, liabilities overdue for more than 5 years account for 64.4% of the total.

84.7% of this debt is older than 2 years.

64.4% belongs to the period over 5 years.

Economic and financial experts have harshly criticized the initiative, describing it as a wrong and dangerous signal. Former Tax Director, Artur Papajani, calls the massive debt write-off a punishment for businesses that have been correct over the years, while legal auditor Julian Saraçi goes further, describing it as a capitulation of the state in the face of tolerated informality. According to him, this is not an agreement, but an expiation of guilt for institutional failures in debt collection. Faktoje.al

Latest news

Vote recount in Tirana, Kaso: We did not have the 14th mandate as our objective

2025-06-19 22:44:53

Noka: Policemen were running from morning to night for SP votes

2025-06-19 21:31:03

The three zodiac signs that will be disappointed in love this month

2025-06-19 21:18:48

Accused of murder due to blood feud, 48-year-old arrested in England

2025-06-19 21:06:57

Vasili releases video: Tirana-Kashar segment full of gravel, no workers around!

2025-06-19 21:00:48

Tirana without a coach, four names considered for the white-and-blue bench

2025-06-19 20:21:12

Rinderpest/ A new outbreak appears in Shkodra, 200 sheep affected

2025-06-19 20:01:50

Scientists raise the alarm: Earth risks exceeding the 1.5°C warming limit!

2025-06-19 19:37:44

"Fiscal Peace" without consultation with the EU, Brussels concerned

2025-06-19 19:05:23

Trump signs executive order extending TikTok ban in US for another three months

2025-06-19 19:03:35

A special Task Force on immigration is established in cooperation with Italy

2025-06-19 18:23:58

Drug trafficking gang busted in Italy, 25 people arrested, including Albanians

2025-06-19 18:18:33

AMF denounces a suspicious cryptocurrency investment platform

2025-06-19 18:06:07

Technology as a tool of war between Israel and Iran

2025-06-19 17:27:54

EU divided over Israel's right to bomb Iran

2025-06-19 16:10:42

Analysis/ How is Russia spreading propaganda in the Albanian language?

2025-06-19 15:49:18

Session in the Criminal Court, MP Qani Xhafa is fined

2025-06-19 15:33:30

Members of criminal organizations! 3 Albanians extradited from Dubai today

2025-06-19 15:20:04

Lufta/ Zelenskyy bën thirrje për rritjen e presionit ndaj Rusisë

2025-06-19 14:56:02

Netanyahu warns Iran after attacks on Israeli hospital

2025-06-19 14:34:53

Attempted to enter Albania with false documents, 25-year-old arrested

2025-06-19 14:18:20

Psychology explains what happens in the brain of a person contemplating suicide

2025-06-19 14:01:25

These are the coldest zodiac signs

2025-06-19 13:45:18

Albanian man dies in hospital after accident in Italy

2025-06-19 13:02:45

Berisha to gather political leaders tomorrow

2025-06-19 12:32:23

Iran confirms meeting with representatives of Britain, Germany and France

2025-06-19 12:11:33

The constitution of the Kosovo Assembly fails for the 34th time

2025-06-19 11:30:28

Albania's nuclear bomb!

2025-06-19 10:52:02

Prej 4 ditësh e zhdukur, humb gjurmët adoleshentja shqiptare në Greqi

2025-06-19 10:33:11

Choosing a child's name, expert reveals three key factors

2025-06-19 10:29:17

Another request for release from house arrest

2025-06-19 09:49:14

Who is the 18-year-old who stole the crown of "Miss Albania 2025"?

2025-06-19 09:41:37

Arrestohet punonjësi i shërbimeve funerale, vidhte në varrezat e Korçës

2025-06-19 09:13:03

Foreign exchange, June 19, 2025

2025-06-19 09:00:33

Montenegrin arrested in Spain for involvement in a structured criminal group

2025-06-19 08:55:04

BBC: Trump has approved the plan to attack Iran

2025-06-19 08:45:01

Draft reports from Brussels expose 'government facade' towards integration

2025-06-19 08:31:21

Horoscope, what do the stars have in store for you today?

2025-06-19 08:17:33

Morning Post/ In 2 lines: What mattered yesterday in Albania

2025-06-19 07:49:56

Zhulali: EU does not tolerate basic standards, membership is a political process

2025-06-18 22:40:09

Recount process/Këlliçi: DP seeks 14th mandate in Tirana

2025-06-18 22:11:20

Hell in the Gjadri camp, 45 attempted injuries and violent protests

2025-06-18 21:49:49

Israel strikes National Police headquarters in Iran, several injured reported

2025-06-18 21:29:11

Why World War III is 'speaking', and the Albanian PM Rama is silent

2025-06-18 20:08:03

Avoid drying towels in the sun, here's how to keep them soft

2025-06-18 20:07:53

Cannabis legalization in Albania, new law, old risks

2025-06-18 19:39:54

Pope Leo XIV calls for peace: Advanced weapons are temptations we must reject

2025-06-18 19:22:29

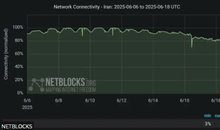

Iran faces near-total internet blackout

2025-06-18 19:07:09

INSTAT: Heart diseases, the leading cause of death in Albania during 2024

2025-06-18 18:05:33