Flash News

Flash News

Accused of murder due to blood feud, 48-year-old arrested in England

SPAK conducts searches at Ergys Agas' businesses and residences, seizes two vehicles

Members of criminal organizations! 3 Albanians extradited from Dubai today

Berisha warns of new facts about the electoral farce: Don't forget that the laptop hasn't started talking yet

Berisha to gather political leaders tomorrow

State Department report 'blackens' Albania: Money laundering linked to drug and human trafficking

The US Department of State has published the 2024 report on the fight against narcotics and money laundering in Albania.

The report states that Albania remains vulnerable to money laundering due to corruption, organized crime and gaps in the legal framework.

Drug trafficking and organized crime activities are major sources of laundered funds, the report further states.

"Albania remains vulnerable to money laundering due to corruption, organized crime and gaps in

its legal and regulatory framework for AML/CFT and obstacles to inter-institutional communications. Albania's economy is highly dependent on cash.

"Remittances and investments from abroad, often in cash, can obscure the sources of funding. Narcotics trafficking and organized crime activities are major sources of funds being laundered. Albanian criminal organizations are directly linked to counterparts in Europe and South America ," the DASH report states, among other things.

Money Laundering Vulnerabilities and Methodologies

Most money laundering in Albania is related to drug and human trafficking. Albania’s largely cash-based economy and weak customs enforcement facilitate a black market for smuggled

goods. Criminals launder proceeds through real estate purchases, construction projects,

virtual assets, and other business development projects.

Parliament's proposed law regarding online gaming raised concerns that weak oversight could allow organized crime to infiltrate the activity.

Albanian authorities are effective in initial asset seizures, but face challenges meeting the evidentiary requirements to finalize the action. Albanian law requires public officials to declare assets annually and to declare preferential financial treatment and beneficial ownership of assets. Provisions prohibit officials from holding significant amounts of money outside the banking system. The law requires companies to register beneficial owners and bank accounts. It requires financial entities to electronically record customer accounts and safe deposit boxes and report them in real time to tax authorities.

This gives authorities access to conduct data analysis, investigate financial crimes, and trace illicit assets.

Most money laundering in Albania is related to drug and human trafficking, government contract fraud, tax evasion, and smuggling. Albania’s largely cash-based economy, weak border controls, and weak customs enforcement facilitate a black market for smuggled goods. Criminals launder proceeds through real estate purchases, construction projects, virtual assets, and other business development projects.

Legal, policy and regulatory shortcomings

Ongoing reforms include vetting judges and prosecutors for unexplained assets. Of the 702 judges and prosecutors reviewed since 2016, 41 percent have been approved to continue in office, with 59 percent removed from office through dismissal, resignation or retirement.

Despite some progress in identifying risks and strengthening supervision, Albania continues to face challenges related to proliferation sanctions, virtual currency, trusts, and non-bank regulation. Courts often refuse to convict for money laundering in the absence of a conviction for a predicate offense.

Albania needs to increase money laundering investigations and prosecutions to combat corruption, organized crime, and drug trafficking; improve inter-institutional cooperation; and fully integrate SPAK into anti-money laundering efforts. Despite numerous money laundering investigations, prosecutions remain low. Albania needs to implement existing laws, follow regulatory guidelines, conduct effective supervision, improve law enforcement cooperation, and expand the capacity of police and prosecutors to focus on corruption, money laundering, and economic crimes.

Latest news

Vote recount in Tirana, Kaso: We did not have the 14th mandate as our objective

2025-06-19 22:44:53

Noka: Policemen were running from morning to night for SP votes

2025-06-19 21:31:03

The three zodiac signs that will be disappointed in love this month

2025-06-19 21:18:48

Accused of murder due to blood feud, 48-year-old arrested in England

2025-06-19 21:06:57

Vasili releases video: Tirana-Kashar segment full of gravel, no workers around!

2025-06-19 21:00:48

Tirana without a coach, four names considered for the white-and-blue bench

2025-06-19 20:21:12

Rinderpest/ A new outbreak appears in Shkodra, 200 sheep affected

2025-06-19 20:01:50

Scientists raise the alarm: Earth risks exceeding the 1.5°C warming limit!

2025-06-19 19:37:44

"Fiscal Peace" without consultation with the EU, Brussels concerned

2025-06-19 19:05:23

Trump signs executive order extending TikTok ban in US for another three months

2025-06-19 19:03:35

A special Task Force on immigration is established in cooperation with Italy

2025-06-19 18:23:58

Drug trafficking gang busted in Italy, 25 people arrested, including Albanians

2025-06-19 18:18:33

AMF denounces a suspicious cryptocurrency investment platform

2025-06-19 18:06:07

Technology as a tool of war between Israel and Iran

2025-06-19 17:27:54

EU divided over Israel's right to bomb Iran

2025-06-19 16:10:42

Analysis/ How is Russia spreading propaganda in the Albanian language?

2025-06-19 15:49:18

Session in the Criminal Court, MP Qani Xhafa is fined

2025-06-19 15:33:30

Members of criminal organizations! 3 Albanians extradited from Dubai today

2025-06-19 15:20:04

Lufta/ Zelenskyy bën thirrje për rritjen e presionit ndaj Rusisë

2025-06-19 14:56:02

Netanyahu warns Iran after attacks on Israeli hospital

2025-06-19 14:34:53

Attempted to enter Albania with false documents, 25-year-old arrested

2025-06-19 14:18:20

Psychology explains what happens in the brain of a person contemplating suicide

2025-06-19 14:01:25

These are the coldest zodiac signs

2025-06-19 13:45:18

Albanian man dies in hospital after accident in Italy

2025-06-19 13:02:45

Berisha to gather political leaders tomorrow

2025-06-19 12:32:23

Iran confirms meeting with representatives of Britain, Germany and France

2025-06-19 12:11:33

The constitution of the Kosovo Assembly fails for the 34th time

2025-06-19 11:30:28

Albania's nuclear bomb!

2025-06-19 10:52:02

Prej 4 ditësh e zhdukur, humb gjurmët adoleshentja shqiptare në Greqi

2025-06-19 10:33:11

Choosing a child's name, expert reveals three key factors

2025-06-19 10:29:17

Another request for release from house arrest

2025-06-19 09:49:14

Who is the 18-year-old who stole the crown of "Miss Albania 2025"?

2025-06-19 09:41:37

Arrestohet punonjësi i shërbimeve funerale, vidhte në varrezat e Korçës

2025-06-19 09:13:03

Foreign exchange, June 19, 2025

2025-06-19 09:00:33

Montenegrin arrested in Spain for involvement in a structured criminal group

2025-06-19 08:55:04

BBC: Trump has approved the plan to attack Iran

2025-06-19 08:45:01

Draft reports from Brussels expose 'government facade' towards integration

2025-06-19 08:31:21

Horoscope, what do the stars have in store for you today?

2025-06-19 08:17:33

Morning Post/ In 2 lines: What mattered yesterday in Albania

2025-06-19 07:49:56

Zhulali: EU does not tolerate basic standards, membership is a political process

2025-06-18 22:40:09

Recount process/Këlliçi: DP seeks 14th mandate in Tirana

2025-06-18 22:11:20

Hell in the Gjadri camp, 45 attempted injuries and violent protests

2025-06-18 21:49:49

Israel strikes National Police headquarters in Iran, several injured reported

2025-06-18 21:29:11

Why World War III is 'speaking', and the Albanian PM Rama is silent

2025-06-18 20:08:03

Avoid drying towels in the sun, here's how to keep them soft

2025-06-18 20:07:53

Cannabis legalization in Albania, new law, old risks

2025-06-18 19:39:54

Pope Leo XIV calls for peace: Advanced weapons are temptations we must reject

2025-06-18 19:22:29

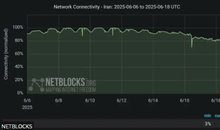

Iran faces near-total internet blackout

2025-06-18 19:07:09

INSTAT: Heart diseases, the leading cause of death in Albania during 2024

2025-06-18 18:05:33