Flash News

Flash News

Drenova prison police officer arrested for bringing drugs and illegal items into cell

Lavrov: NATO is risking self-destruction with new military budget

Kurti and Vučić "face off" tomorrow in Skopje

Construction worker dies after falling from scaffolding in Berat

The prosecution sends two Korça Municipality officials to trial

'Fiscal amnesty', the European Commission 'slaps' Rama: Essential risk for the country's reputation

The European Commission has expressed concern about the law on fiscal amnesty that the Albanian government will approve.

Through a statement from the EU delegation in Tirana, the European Commission underlines that the draft of the "Rama" government will damage Albania's reputation and that it would weaken Albania's controls against money laundering.

"The commission highlighted serious concerns about the current draft law on fiscal amnesty. It would weaken Albania's anti-money laundering controls while doing little to enhance the tax administration's ability to improve future compliance with tax requirements.

Furthermore, because non-tax residents, including Albanians living in the EU or the Western Balkans, fall within its scope and are required to import cash in order to benefit from the amnesty, the current draft of the law raises serious concerns for Member States of the EU and other partners, as well as an essential reputational risk for the country", says the announcement of the EU office in Tirana after the 13th meeting of the Subcommittee on Trade, Industry, Customs and Taxation between the EU and Albania in Brussels.

The Ministry of Finance and Economy has prepared the draft law "for Fiscal Amnesty", which allows an individual together with his family members to have the opportunity to legalize assets worth up to 2 million euros.

Individuals who benefit from this pardon must be Albanian citizens, regardless of where they live, and must not hold or have held high public positions.

In addition to monetary values, the legalization of real estate, business balance sheets, and valuables such as cars, works of art, and precious stones will be allowed. For the latter, the persons who will make the crossing at the border points will be equipped with a special certificate from the authorities.

The amnesty process will last 9 months and the tax that will be withheld for those who declare the first 4 months is 7% of the value and 10% for the last months.

Latest news

Second hearing on the protected areas law, Zhupa: Unconstitutional and dangerous

2025-06-30 22:18:46

Israel-Iran conflict, Bushati: Albanians should be concerned

2025-06-30 21:32:42

Fuga: Journalism in Albania today in severe crisis

2025-06-30 21:07:11

"There is no room for panic"/ Moore: Serbia does not dare to attack Kosovo!

2025-06-30 20:49:53

Temperatures above 40 degrees, France closes nuclear plants and schools

2025-06-30 20:28:42

Lavrov: NATO is risking self-destruction with new military budget

2025-06-30 20:13:54

Turkey against the "Bektashi state" in Albania: Give up this idea!

2025-06-30 20:03:24

Accused of sexual abuse, producer Diddy awaits court decision

2025-06-30 19:40:44

Kurti and Vučić "face off" tomorrow in Skopje

2025-06-30 18:44:12

Tourism: new season, old problems

2025-06-30 18:27:23

Construction worker dies after falling from scaffolding in Berat

2025-06-30 17:51:44

Almost free housing: East Germany against depopulation

2025-06-30 16:43:06

Hamas says nearly 60 people killed in Gaza as Trump calls for ceasefire

2025-06-30 16:14:15

Drownings on beaches/ Expert Softa: Negligence and incompetence by institutions!

2025-06-30 16:00:03

European ports are overloaded due to Trump tariffs

2025-06-30 15:30:44

The prosecution sends two Korça Municipality officials to trial

2025-06-30 15:19:54

Lezha/ Police impose 3165 administrative measures, handcuff 19 drivers

2025-06-30 14:55:04

Young people leave Albania in search of a more sustainable future

2025-06-30 14:47:52

Record-breaking summer, health threats and preventive measures

2025-06-30 14:36:19

Constitution of the Parliament, Osmani invites political leaders to a meeting

2025-06-30 14:07:54

Heat wave 'invades' Europe, Spain records temperatures up to 46 degrees Celsius

2025-06-30 13:42:02

Accident in Vlora, car hits 2 tourists

2025-06-30 13:32:16

Kurti confirms participation in today's official dinner in Skopje

2025-06-30 13:03:27

Fight between 4 minors in Kosovo, one of them injured with a knife

2025-06-30 12:38:45

Report: Teenage girls the loneliest in the world

2025-06-30 12:20:40

Commissioner Kos and Balkan leaders meet in Skopje on Growth Plan

2025-06-30 12:07:59

Wanted by Italy, member of a criminal organization captured in Fier

2025-06-30 11:55:53

Hundreds of families displaced by wave of Israeli airstrikes in Gaza

2025-06-30 11:45:17

Zenel Beshi: The criminal who even 50 convictions won't move from Britain

2025-06-30 11:23:19

A new variant of Covid will circulate during the summer, here are the symptoms

2025-06-30 11:14:58

"Partizani" case, trial postponed to July 21 at the Special Court

2025-06-30 10:41:05

Uncontrolled desire to steal, what is kleptomania, why is it caused

2025-06-30 10:30:08

Requested change of security measure, hearing for Malltez postponed to July 7

2025-06-30 10:24:32

Output per working hour in Albania 35% lower than the regional average

2025-06-30 09:54:35

The trial for the "Partizani" file begins today

2025-06-30 09:27:57

22 fires in the last 24 hours in the country, 2 still active

2025-06-30 09:21:28

How is the media controlled? The 'Rama' case and government propaganda

2025-06-30 09:13:36

German top diplomat: Putin wants Ukraine to capitulate

2025-06-30 09:00:07

Foreign exchange, how much foreign currencies are sold and bought today

2025-06-30 08:44:38

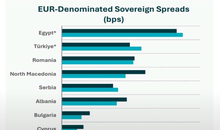

Chart/ Sovereign risk for Albania from international markets drops significantly

2025-06-30 08:26:38

Horoscope, what do the stars have in store for you?

2025-06-30 08:11:44

Clear weather and passing clouds, here is the forecast for this Monday

2025-06-30 07:59:32

Morning Post/ In 2 lines: What mattered yesterday in Albania

2025-06-30 07:47:37

Milan make official two departures in attack

2025-06-29 21:57:23

6 record tone

2025-06-29 21:30:46

4-year-old girl falls from balcony in Lezha, urgently taken to Trauma

2025-06-29 21:09:58

Assets worth 12 million euros seized from cocaine trafficking organization

2025-06-29 19:39:43

Fire in Durrës, Blushi: The state exists only on paper

2025-06-29 19:17:48

Fire endangers homes in Vlora, helicopter intervention begins

2025-06-29 18:27:51

France implements smoking ban on beaches and parks

2025-06-29 18:02:08

England U-21 beat Germany to become European champions

2025-06-29 17:42:49

Trump criticizes Israeli prosecutors over Netanyahu's corruption trial

2025-06-29 17:08:10

Street market in Durrës engulfed in flames

2025-06-29 16:52:57

UN nuclear chief: Iran could resume uranium enrichment within months

2025-06-29 16:03:24

Albanian man dies after falling from cliff while climbing mountain in Italy

2025-06-29 15:52:01

Another accident with a single-track vehicle in Tirana, a car hits a 17-year-old

2025-06-29 15:07:15

While bathing in the sea, a vacationer in Durrës dies

2025-06-29 14:54:01

Sentenced to life imprisonment, cell phone found in Laert Haxhiu's cell

2025-06-29 14:26:40

77 people detained in protest, Vučić warns of new arrests

2025-06-29 14:07:46