Flash News

Flash News

Drenova prison police officer arrested for bringing drugs and illegal items into cell

Lavrov: NATO is risking self-destruction with new military budget

Kurti and Vučić "face off" tomorrow in Skopje

Construction worker dies after falling from scaffolding in Berat

The prosecution sends two Korça Municipality officials to trial

The Bank of Albania 'closes the doors' to the microfinance of fast loans, there will be no new licenses

The Bank of Albania has decided to take a strict approach to the granting of new licenses to financial institutions for quick microcredits.

Sources from the market inform that in the last two years, several applications submitted by specific entities that relied on business plans of this type have been rejected by the Bank of Albania.

This includes foreign investors, as is the case of one of the most important microcredit entities in Bulgaria, Easy Credit.

The Bank of Albania has argued that it will not prevent the licensing of new financial lending institutions, but their business model should not rely only on fast loans, with very high interest rates.

By analogy, the central bank does not rule out granting licenses to institutions of the NOA or BESA model, which have a wider spectrum of products and individual and business clients, but it seems that it will not allow the licensing of new financial institutions of the IuteCredit model or Kredo Finance, who have built their business exclusively based on quick consumer loans.

Apparently, the Bank of Albania estimates that the further expansion of this business model, besides being associated with high risks for the lender and the borrower, does not serve the public interest.

Microfinance of fast loans has seen a rapid development in the last decade. This business model relies on taking on high risks, which in turn are compensated by small loan amounts and very high effective interest rates.

The high rates applied by institutions became the main reason that the Bank of Albania decided to apply a ceiling interest rate for consumer loans in Albania, at the beginning of the year 2022. According to the Bank of Albania, the main reason was to protect the consumer from potentially abusive interest, applied mainly by some non-bank financial institutions.

Based on the data of the Bank of Albania, effective interest rates before the entry into force of the regulation reached up to 256% for loans in small amounts and minimum maturities.

According to the regulation "On consumer and mortgage loans", the maximum NEI is calculated by the Bank of Albania on a six-monthly basis, based on the data of the Credit Register administered by it.

Maximum NEI levels are published at the beginning of each 6-month period and are based on loans disbursed in the previous six-month period. This indicator is constructed as the average of the effective interest rate for each product and interval, increased by one third.

The maximum NEI is mandatory to be respected by all banks and financial institutions licensed for lending activity in Albania.

However, in addition to the application of a ceiling interest rate, the Bank of Albania has already imposed a tightening in this segment of the market also at the licensing level./MONITOR

Latest news

Second hearing on the protected areas law, Zhupa: Unconstitutional and dangerous

2025-06-30 22:18:46

Israel-Iran conflict, Bushati: Albanians should be concerned

2025-06-30 21:32:42

Fuga: Journalism in Albania today in severe crisis

2025-06-30 21:07:11

"There is no room for panic"/ Moore: Serbia does not dare to attack Kosovo!

2025-06-30 20:49:53

Temperatures above 40 degrees, France closes nuclear plants and schools

2025-06-30 20:28:42

Lavrov: NATO is risking self-destruction with new military budget

2025-06-30 20:13:54

Turkey against the "Bektashi state" in Albania: Give up this idea!

2025-06-30 20:03:24

Accused of sexual abuse, producer Diddy awaits court decision

2025-06-30 19:40:44

Kurti and Vučić "face off" tomorrow in Skopje

2025-06-30 18:44:12

Tourism: new season, old problems

2025-06-30 18:27:23

Construction worker dies after falling from scaffolding in Berat

2025-06-30 17:51:44

Almost free housing: East Germany against depopulation

2025-06-30 16:43:06

Hamas says nearly 60 people killed in Gaza as Trump calls for ceasefire

2025-06-30 16:14:15

Drownings on beaches/ Expert Softa: Negligence and incompetence by institutions!

2025-06-30 16:00:03

European ports are overloaded due to Trump tariffs

2025-06-30 15:30:44

The prosecution sends two Korça Municipality officials to trial

2025-06-30 15:19:54

Lezha/ Police impose 3165 administrative measures, handcuff 19 drivers

2025-06-30 14:55:04

Young people leave Albania in search of a more sustainable future

2025-06-30 14:47:52

Record-breaking summer, health threats and preventive measures

2025-06-30 14:36:19

Constitution of the Parliament, Osmani invites political leaders to a meeting

2025-06-30 14:07:54

Heat wave 'invades' Europe, Spain records temperatures up to 46 degrees Celsius

2025-06-30 13:42:02

Accident in Vlora, car hits 2 tourists

2025-06-30 13:32:16

Kurti confirms participation in today's official dinner in Skopje

2025-06-30 13:03:27

Fight between 4 minors in Kosovo, one of them injured with a knife

2025-06-30 12:38:45

Report: Teenage girls the loneliest in the world

2025-06-30 12:20:40

Commissioner Kos and Balkan leaders meet in Skopje on Growth Plan

2025-06-30 12:07:59

Wanted by Italy, member of a criminal organization captured in Fier

2025-06-30 11:55:53

Hundreds of families displaced by wave of Israeli airstrikes in Gaza

2025-06-30 11:45:17

Zenel Beshi: The criminal who even 50 convictions won't move from Britain

2025-06-30 11:23:19

A new variant of Covid will circulate during the summer, here are the symptoms

2025-06-30 11:14:58

"Partizani" case, trial postponed to July 21 at the Special Court

2025-06-30 10:41:05

Uncontrolled desire to steal, what is kleptomania, why is it caused

2025-06-30 10:30:08

Requested change of security measure, hearing for Malltez postponed to July 7

2025-06-30 10:24:32

Output per working hour in Albania 35% lower than the regional average

2025-06-30 09:54:35

The trial for the "Partizani" file begins today

2025-06-30 09:27:57

22 fires in the last 24 hours in the country, 2 still active

2025-06-30 09:21:28

How is the media controlled? The 'Rama' case and government propaganda

2025-06-30 09:13:36

German top diplomat: Putin wants Ukraine to capitulate

2025-06-30 09:00:07

Foreign exchange, how much foreign currencies are sold and bought today

2025-06-30 08:44:38

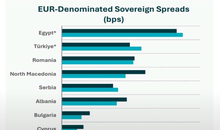

Chart/ Sovereign risk for Albania from international markets drops significantly

2025-06-30 08:26:38

Horoscope, what do the stars have in store for you?

2025-06-30 08:11:44

Clear weather and passing clouds, here is the forecast for this Monday

2025-06-30 07:59:32

Morning Post/ In 2 lines: What mattered yesterday in Albania

2025-06-30 07:47:37

Milan make official two departures in attack

2025-06-29 21:57:23

6 record tone

2025-06-29 21:30:46

4-year-old girl falls from balcony in Lezha, urgently taken to Trauma

2025-06-29 21:09:58

Assets worth 12 million euros seized from cocaine trafficking organization

2025-06-29 19:39:43

Fire in Durrës, Blushi: The state exists only on paper

2025-06-29 19:17:48

Fire endangers homes in Vlora, helicopter intervention begins

2025-06-29 18:27:51

France implements smoking ban on beaches and parks

2025-06-29 18:02:08

England U-21 beat Germany to become European champions

2025-06-29 17:42:49

Trump criticizes Israeli prosecutors over Netanyahu's corruption trial

2025-06-29 17:08:10

Street market in Durrës engulfed in flames

2025-06-29 16:52:57

UN nuclear chief: Iran could resume uranium enrichment within months

2025-06-29 16:03:24

Albanian man dies after falling from cliff while climbing mountain in Italy

2025-06-29 15:52:01

Another accident with a single-track vehicle in Tirana, a car hits a 17-year-old

2025-06-29 15:07:15

While bathing in the sea, a vacationer in Durrës dies

2025-06-29 14:54:01

Sentenced to life imprisonment, cell phone found in Laert Haxhiu's cell

2025-06-29 14:26:40

77 people detained in protest, Vučić warns of new arrests

2025-06-29 14:07:46