Flash News

Flash News

Drenova prison police officer arrested for bringing drugs and illegal items into cell

Lavrov: NATO is risking self-destruction with new military budget

Kurti and Vučić "face off" tomorrow in Skopje

Construction worker dies after falling from scaffolding in Berat

The prosecution sends two Korça Municipality officials to trial

New Income Law/ Employees sign personal status declaration, how should dual-employed people act

All employees must sign a personal status declaration, based on the new income tax law.

This declaration, which is signed for the purposes of applying deductions from the tax base specified in Articles 20 and 22 of point 1, letters "a", "b" and "c" of this Law, in fact only affects those who are in more than one employment relationship.

For people who are only in an employment relationship, nothing changes after signing the declaration.

Those who work in two or more jobs must sign this declaration only for one of the employers. The two or more employees must choose the entity where the employee decides to apply the non-taxable salary limit according to articles 20 and 22 of Law No. 29,2023 “On Income Tax” (up to 30 thousand lek). Other entities where the employee has an employment relationship will withhold salary tax on the entire amount without making any deductions.

According to the income tax law, salaries up to 30 thousand lek are taxed at zero, from 30-200 thousand lek at 13% and over 200 thousand lek at 23%. When the salary is 40 thousand lek or less, it is taxed at zero and when it is up to 50 thousand lek, it is taxed at 50% * 13% of the amount over 30,000 lek.

Until now, dual employees received their salary from each company they worked for, and each was taxed individually. For example, if an individual had two salaries of 100 thousand lek, he was exempt from tax up to 30 thousand lek for both salaries and then 13% was taxed from 30-100 thousand lek. At the beginning of the following year, the dual employee filed a personal income tax return, where he paid additional tax, since he does not benefit from zero tax up to 30 thousand lek for one salary. Now this tax (13% of 30 thousand lek) will be withheld during the year by one of the employers and when he files his personal income tax return by March 31 of the following year, he will no longer have to pay it.

For dual employees, whose combined salary exceeds 200 thousand lek per month, or 2.4 million lek per year and as a result the addition after 200 thousand lek is taxed at 23%, they will have tax withheld on 30 thousand lek of one salary during the year, but will still have to pay the additional tax of 23% when they file their personal income declaration at the beginning of next year.

While the amount paid as tax does not change, the relief for dual-employed people is related to the fact that they will no longer have to pay the additional obligation at the beginning of next year, but it will be deducted from one salary during the year, in the case where the salaries collected do not exceed 200 thousand lek.

Në rast se dy pagat bashkë e kalojnë kufirin e 200 mijë lekë në muaj, ata sërish duhet të bëjnë pagesë 23% të shumës mbi 2.4 milionë lekë në vit, me deklarimin e të ardhurave personale, por ndërkohë gjatë vitit do tu mbahet tatimi prej 13% deri në 30 mijë lekë, për njërën pagë.

Në udhëzimin e përgjithshëm Nr. 26, datë 8.9.2023, për tatimin mbi të ardhurat jepen dhe tre shembujt përkatës si do të veprohet. Fillimisht udhëzimi parashikonte që deklarata do të kërkohet që për listëpagesën e janar 2024, por më pas afati u shty edhe me një vit. Akti normativ nr.7 dt.14.12.2023 përcakton që nis zbatimi që nga 1 Janari 2025. Financierët pohojnë se ata janë ende në pritje se si do të veprojnë në listpagesat e janarit 2025 për personat që janë të dypunësur, tek subjekti i dytë ku punëmarrësi nuk ka firmosur deklaratën e statusit personal.

SHEMBUJT

Shembull 1

Punëmarrësi K.P. është i punësuar në subjektin “Alpha”, dhe ka kontratë punësimi me pagë bruto mujore 100.000 lekë. Njëkohësisht K.P. në darkë punon me orar të reduktuar te subjekti “Beta”, me të cilin ka kontratë punësimi me pagë bruto mujore 50.000 lekë.

Punëmarrësi K.P. dorëzon te punëdhënësi “Alpha” “Deklaratën mbi statusin personal” dhe mbi këtë bazë, subjekti i llogarit në listëpagesë detyrimin e tatimit mbi të ardhurat personale nga paga 100.000 – 30.000 = 70.000 x 13 % = 9.100 lekë tatim.

Punëmarrësi K.P. nuk duhet të dorëzojë te punëdhënësi i dytë “Beta” “Deklaratën mbi statusin personal”. Punëdhënësi “Beta” i llogarit në listëpagesë detyrimin e tatimit mbi të ardhurat personale nga paga 50.000 x 13 % = 6.500 lekë tatim.

Në fund të vitit, brenda datës 31 mars të vitit pasardhës, individi K.P, bazuar në nenin 67 të ligjit, është i detyruar të dorëzojë “Deklaratën vjetore e të ardhurave personale”, ku do rillogarisë detyrimin tatimor të tatimit mbi të ardhurat personale nga paga, pasi ka qenë i dypunësuar”.

– Të ardhurat mujore nga paga të realizuara: 100.000 + 50.000 = 150.000 lekë.

– Tatimi i pagueshëm për të ardhurat e realizuara 150.000 – 30.000 = 120.000 x 13 % = 15.600 lekë.

– Tatimi mbi baza mujore i paguar gjatë vitit: 9.100+6.500= 15600 lekë në muaj.

– Tatimi i mbipaguar apo për t’u paguar: zero.

Shembull 2

Nëse të ardhurat e individit K.P., i cili do të punonte me kohë të pjesshme te të dyja subjektet, do të ishin 25.000 lekë te punëdhënësi i parë dhe 25.000 lekë te punëdhënësi i dytë.

– Të ardhurat mujore nga paga të realizuara: 25.000 lekë + 25.000 lekë = 50.000 lekë.

– Tatimi i pagueshëm mujor për të ardhurat e realizuara 50.000 – 50.000 = 0 => 0 x 13 % = 0 lekë

– Tatimi mbi baza mujore i paguar gjatë vitit: i. 25.000 lekë – 25.000 = 0 => 0 x 13% = 0 lekë tatim; dhe ii. 25.000 x 13 % = 3.250 lekë tatim. Gjithsej tatimi i paguar 3.250 lekë.

– Tatimi i mbipaguar: 3.250 lekë – 0 lekë = 3.250 lekë në muaj ose 39.000 lekë në vit, të cilat i kthehen të punësuarit.

Shembull 3

Nëse të ardhurat mujore të individit K.P. do të ishin 200.000 lekë te punëdhënësi i parë dhe 180.000 lekë te punëdhënësi i dytë.

– Monthly income from earned wages: 200,000 + 180,000 = 380,000 lek.

– Tax payable on income earned 380,000 – 30,000 = 350,000 lek per month. (170,000 x 13 %) + (180,000 x 23 %) = 22,100 + 41,400 = 63,500 lek monthly tax.

– Monthly tax paid during the year: i. 200,000 lek – 30,000 = 170,000 x 13% = 22,100 lek tax; and ii. 170,000 x 13% + 10,000 x 23% = 24,400 lek tax. Total tax paid 46,500 lek tax.

– Additional monthly tax to be paid: 63,500 – 46,500 = 17,000 lek per month or 204,000 lek per year, which the employee must pay by March 31 of the following year according to the “Annual Personal Income Declaration”.

To be treated as income from employment and so that the tax liability is calculated according to the progressive rates of 13% and 23% provided for in the law, the employer must also be responsible for calculating the obligations for social security and health insurance contributions./Monitor.al

Latest news

Second hearing on the protected areas law, Zhupa: Unconstitutional and dangerous

2025-06-30 22:18:46

Israel-Iran conflict, Bushati: Albanians should be concerned

2025-06-30 21:32:42

Fuga: Journalism in Albania today in severe crisis

2025-06-30 21:07:11

"There is no room for panic"/ Moore: Serbia does not dare to attack Kosovo!

2025-06-30 20:49:53

Temperatures above 40 degrees, France closes nuclear plants and schools

2025-06-30 20:28:42

Lavrov: NATO is risking self-destruction with new military budget

2025-06-30 20:13:54

Turkey against the "Bektashi state" in Albania: Give up this idea!

2025-06-30 20:03:24

Accused of sexual abuse, producer Diddy awaits court decision

2025-06-30 19:40:44

Kurti and Vučić "face off" tomorrow in Skopje

2025-06-30 18:44:12

Tourism: new season, old problems

2025-06-30 18:27:23

Construction worker dies after falling from scaffolding in Berat

2025-06-30 17:51:44

Almost free housing: East Germany against depopulation

2025-06-30 16:43:06

Hamas says nearly 60 people killed in Gaza as Trump calls for ceasefire

2025-06-30 16:14:15

Drownings on beaches/ Expert Softa: Negligence and incompetence by institutions!

2025-06-30 16:00:03

European ports are overloaded due to Trump tariffs

2025-06-30 15:30:44

The prosecution sends two Korça Municipality officials to trial

2025-06-30 15:19:54

Lezha/ Police impose 3165 administrative measures, handcuff 19 drivers

2025-06-30 14:55:04

Young people leave Albania in search of a more sustainable future

2025-06-30 14:47:52

Record-breaking summer, health threats and preventive measures

2025-06-30 14:36:19

Constitution of the Parliament, Osmani invites political leaders to a meeting

2025-06-30 14:07:54

Heat wave 'invades' Europe, Spain records temperatures up to 46 degrees Celsius

2025-06-30 13:42:02

Accident in Vlora, car hits 2 tourists

2025-06-30 13:32:16

Kurti confirms participation in today's official dinner in Skopje

2025-06-30 13:03:27

Fight between 4 minors in Kosovo, one of them injured with a knife

2025-06-30 12:38:45

Report: Teenage girls the loneliest in the world

2025-06-30 12:20:40

Commissioner Kos and Balkan leaders meet in Skopje on Growth Plan

2025-06-30 12:07:59

Wanted by Italy, member of a criminal organization captured in Fier

2025-06-30 11:55:53

Hundreds of families displaced by wave of Israeli airstrikes in Gaza

2025-06-30 11:45:17

Zenel Beshi: The criminal who even 50 convictions won't move from Britain

2025-06-30 11:23:19

A new variant of Covid will circulate during the summer, here are the symptoms

2025-06-30 11:14:58

"Partizani" case, trial postponed to July 21 at the Special Court

2025-06-30 10:41:05

Uncontrolled desire to steal, what is kleptomania, why is it caused

2025-06-30 10:30:08

Requested change of security measure, hearing for Malltez postponed to July 7

2025-06-30 10:24:32

Output per working hour in Albania 35% lower than the regional average

2025-06-30 09:54:35

The trial for the "Partizani" file begins today

2025-06-30 09:27:57

22 fires in the last 24 hours in the country, 2 still active

2025-06-30 09:21:28

How is the media controlled? The 'Rama' case and government propaganda

2025-06-30 09:13:36

German top diplomat: Putin wants Ukraine to capitulate

2025-06-30 09:00:07

Foreign exchange, how much foreign currencies are sold and bought today

2025-06-30 08:44:38

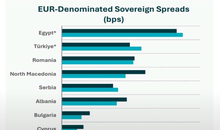

Chart/ Sovereign risk for Albania from international markets drops significantly

2025-06-30 08:26:38

Horoscope, what do the stars have in store for you?

2025-06-30 08:11:44

Clear weather and passing clouds, here is the forecast for this Monday

2025-06-30 07:59:32

Morning Post/ In 2 lines: What mattered yesterday in Albania

2025-06-30 07:47:37

Milan make official two departures in attack

2025-06-29 21:57:23

6 record tone

2025-06-29 21:30:46

4-year-old girl falls from balcony in Lezha, urgently taken to Trauma

2025-06-29 21:09:58

Assets worth 12 million euros seized from cocaine trafficking organization

2025-06-29 19:39:43

Fire in Durrës, Blushi: The state exists only on paper

2025-06-29 19:17:48

Fire endangers homes in Vlora, helicopter intervention begins

2025-06-29 18:27:51

France implements smoking ban on beaches and parks

2025-06-29 18:02:08

England U-21 beat Germany to become European champions

2025-06-29 17:42:49

Trump criticizes Israeli prosecutors over Netanyahu's corruption trial

2025-06-29 17:08:10

Street market in Durrës engulfed in flames

2025-06-29 16:52:57

UN nuclear chief: Iran could resume uranium enrichment within months

2025-06-29 16:03:24

Albanian man dies after falling from cliff while climbing mountain in Italy

2025-06-29 15:52:01

Another accident with a single-track vehicle in Tirana, a car hits a 17-year-old

2025-06-29 15:07:15

While bathing in the sea, a vacationer in Durrës dies

2025-06-29 14:54:01

Sentenced to life imprisonment, cell phone found in Laert Haxhiu's cell

2025-06-29 14:26:40

77 people detained in protest, Vučić warns of new arrests

2025-06-29 14:07:46