Flash News

Flash News

Drenova prison police officer arrested for bringing drugs and illegal items into cell

Lavrov: NATO is risking self-destruction with new military budget

Kurti and Vučić "face off" tomorrow in Skopje

Construction worker dies after falling from scaffolding in Berat

The prosecution sends two Korça Municipality officials to trial

For now, there is a buoyancy in the steps of European Union officials — at least compared to the dark atmosphere that prevailed a few months ago — as Donald Trump's trade war and attacks on the rule of law are pushing Europeans closer together and investors are seeking refuge in the euro.

The question that arises is: how far can this new impulse go in realizing the necessary changes, given that Germany is facing its third consecutive year of stagnation and Mario Draghi's warnings of a "slow agony" continue to ring in the ears of technocrats.

Trump's direct attack on the $1.5 trillion transatlantic relationship has done a better job of proving the EU's value than 1,000 research papers.

The attacks on NATO and Ukraine are increasing solidarity among member states, with Denmark, a traditionally pro-US country, abandoning its Euroscepticism after pressure over Greenland.

Also, the chances of Norway and Iceland joining are changing, and even the UK is moving closer to Brussels, while the special relationship with the US is fading.

While the EU's single market, with 440 million inhabitants, holds its own in the face of Trump, member states are also more willing to break national taboos for the common good.

Germany’s new coalition is pulling the country out of austerity[1] with a package of more than 500 billion euros ($574 billion) for infrastructure and defense. It has also made a significant move recently by calling for an easing of EU fiscal rules that it once strongly supported.

Meanwhile, France is willing to consider the possibility of shaping continental defenses with an expanded nuclear deterrent, an idea that appeals to Poland as the US tightens ties with Russia.

And at a time when the tide of investment and research is turning in Europe's favor, it has become easier to highlight its stability, predictability, and equality compared to America.

“We have no close friends and no oligarchs,” European Commission President Ursula von der Leyen said recently, as the executive body struggles to secure funding and other incentives to attract scientists who have been neglected by the Trump administration.

The U.S. dollar has lost about 9% of its value this year against a basket of world currencies, while the euro has strengthened by about 5%. Defense stocks, such as Rheinmetall AG, have seen big gains.

However, the EU still seems unprepared for the storm that awaits it.

Its economy is twice as dependent on foreign trade as the US, with Germany being particularly vulnerable due to its dependence on America for more than 10% of its exports of goods such as vehicles and medicines, according to Bloomberg Economics.

The International Monetary Fund's latest projection predicts that Germany's output will remain flat this year — and, given the high uncertainty, there is a chance that Germany's economy will contract for a third consecutive year, warns ING economist Charlotte de Montpellier.

In addition to the job losses and popular discontent that a tariff war with Trump could bring, there is also the risk that the EU could end up fighting a trade war on two fronts, while China is ramping up its export engine and driving a flood of goods into Europe.

The test of the coming summer, which will bring trade pain, is not whether the EU can broker a deal with Trump within 90 days, as LVMH billionaire Bernard Arnault seems to think.

The test is whether the EU will start implementing Mario Draghi's recipe for success, which has been out for a year, by strengthening fragmented domestic industries, creating a true single market for banks and integrating its fragmented capital markets.

New markets and alliances abroad will help; however, as IMF Managing Director Kristalina Georgieva points out, only a combination of greater spending and more integration will boost growth and improve Europe's resilience.

Since it will take time to put the new spending plans into practice, it is perhaps not so comforting that the new German government's policies still lack substance in areas such as pensions or reducing bureaucracy.

No matter how strong Europe appears amid the US-led chaos, attracting talent and investment, while simultaneously mitigating the pull of populists at home, will require a new level of cooperation.

“We cannot stop halfway,” European Central Bank President Christine Lagarde warned this month.

Her own institution is facing the challenge of easing monetary policy to boost demand; it is time for governments to start removing their own obstacles to economic growth, which Draghi, Lagarde's predecessor, equates to a 45% tariff on goods and a 110% tax on services.

If that means addressing other taboos — like the need for qualified majority voting among EU member states — then so be it. It would be another welcome, if painful, companion to Trump’s behavior./ Bloomberg

Latest news

Second hearing on the protected areas law, Zhupa: Unconstitutional and dangerous

2025-06-30 22:18:46

Israel-Iran conflict, Bushati: Albanians should be concerned

2025-06-30 21:32:42

Fuga: Journalism in Albania today in severe crisis

2025-06-30 21:07:11

"There is no room for panic"/ Moore: Serbia does not dare to attack Kosovo!

2025-06-30 20:49:53

Temperatures above 40 degrees, France closes nuclear plants and schools

2025-06-30 20:28:42

Lavrov: NATO is risking self-destruction with new military budget

2025-06-30 20:13:54

Turkey against the "Bektashi state" in Albania: Give up this idea!

2025-06-30 20:03:24

Accused of sexual abuse, producer Diddy awaits court decision

2025-06-30 19:40:44

Kurti and Vučić "face off" tomorrow in Skopje

2025-06-30 18:44:12

Tourism: new season, old problems

2025-06-30 18:27:23

Construction worker dies after falling from scaffolding in Berat

2025-06-30 17:51:44

Almost free housing: East Germany against depopulation

2025-06-30 16:43:06

Hamas says nearly 60 people killed in Gaza as Trump calls for ceasefire

2025-06-30 16:14:15

Drownings on beaches/ Expert Softa: Negligence and incompetence by institutions!

2025-06-30 16:00:03

European ports are overloaded due to Trump tariffs

2025-06-30 15:30:44

The prosecution sends two Korça Municipality officials to trial

2025-06-30 15:19:54

Lezha/ Police impose 3165 administrative measures, handcuff 19 drivers

2025-06-30 14:55:04

Young people leave Albania in search of a more sustainable future

2025-06-30 14:47:52

Record-breaking summer, health threats and preventive measures

2025-06-30 14:36:19

Constitution of the Parliament, Osmani invites political leaders to a meeting

2025-06-30 14:07:54

Heat wave 'invades' Europe, Spain records temperatures up to 46 degrees Celsius

2025-06-30 13:42:02

Accident in Vlora, car hits 2 tourists

2025-06-30 13:32:16

Kurti confirms participation in today's official dinner in Skopje

2025-06-30 13:03:27

Fight between 4 minors in Kosovo, one of them injured with a knife

2025-06-30 12:38:45

Report: Teenage girls the loneliest in the world

2025-06-30 12:20:40

Commissioner Kos and Balkan leaders meet in Skopje on Growth Plan

2025-06-30 12:07:59

Wanted by Italy, member of a criminal organization captured in Fier

2025-06-30 11:55:53

Hundreds of families displaced by wave of Israeli airstrikes in Gaza

2025-06-30 11:45:17

Zenel Beshi: The criminal who even 50 convictions won't move from Britain

2025-06-30 11:23:19

A new variant of Covid will circulate during the summer, here are the symptoms

2025-06-30 11:14:58

"Partizani" case, trial postponed to July 21 at the Special Court

2025-06-30 10:41:05

Uncontrolled desire to steal, what is kleptomania, why is it caused

2025-06-30 10:30:08

Requested change of security measure, hearing for Malltez postponed to July 7

2025-06-30 10:24:32

Output per working hour in Albania 35% lower than the regional average

2025-06-30 09:54:35

The trial for the "Partizani" file begins today

2025-06-30 09:27:57

22 fires in the last 24 hours in the country, 2 still active

2025-06-30 09:21:28

How is the media controlled? The 'Rama' case and government propaganda

2025-06-30 09:13:36

German top diplomat: Putin wants Ukraine to capitulate

2025-06-30 09:00:07

Foreign exchange, how much foreign currencies are sold and bought today

2025-06-30 08:44:38

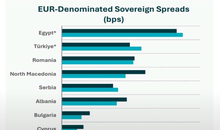

Chart/ Sovereign risk for Albania from international markets drops significantly

2025-06-30 08:26:38

Horoscope, what do the stars have in store for you?

2025-06-30 08:11:44

Clear weather and passing clouds, here is the forecast for this Monday

2025-06-30 07:59:32

Morning Post/ In 2 lines: What mattered yesterday in Albania

2025-06-30 07:47:37

Milan make official two departures in attack

2025-06-29 21:57:23

6 record tone

2025-06-29 21:30:46

4-year-old girl falls from balcony in Lezha, urgently taken to Trauma

2025-06-29 21:09:58

Assets worth 12 million euros seized from cocaine trafficking organization

2025-06-29 19:39:43

Fire in Durrës, Blushi: The state exists only on paper

2025-06-29 19:17:48

Fire endangers homes in Vlora, helicopter intervention begins

2025-06-29 18:27:51

France implements smoking ban on beaches and parks

2025-06-29 18:02:08

England U-21 beat Germany to become European champions

2025-06-29 17:42:49

Trump criticizes Israeli prosecutors over Netanyahu's corruption trial

2025-06-29 17:08:10

Street market in Durrës engulfed in flames

2025-06-29 16:52:57

UN nuclear chief: Iran could resume uranium enrichment within months

2025-06-29 16:03:24

Albanian man dies after falling from cliff while climbing mountain in Italy

2025-06-29 15:52:01

Another accident with a single-track vehicle in Tirana, a car hits a 17-year-old

2025-06-29 15:07:15

While bathing in the sea, a vacationer in Durrës dies

2025-06-29 14:54:01

Sentenced to life imprisonment, cell phone found in Laert Haxhiu's cell

2025-06-29 14:26:40

77 people detained in protest, Vučić warns of new arrests

2025-06-29 14:07:46